Question: Question 2 - A Small Business Dilemma (10 marks) A Sports Exports Company (shortly called SEC) receives pounds each month as payment for the footballs

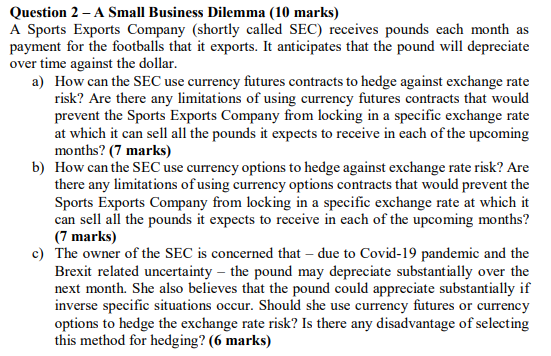

Question 2 - A Small Business Dilemma (10 marks) A Sports Exports Company (shortly called SEC) receives pounds each month as payment for the footballs that it exports. It anticipates that the pound will depreciate over time against the dollar. a) How can the SEC use currency futures contracts to hedge against exchange rate risk? Are there any limitations of using currency futures contracts that would prevent the Sports Exports Company from locking in a specific exchange rate at which it can sell all the pounds it expects to receive in each of the upcoming months? (7 marks) b) How can the SEC use currency options to hedge against exchange rate risk? Are there any limitations of using currency options contracts that would prevent the Sports Exports Company from locking in a specific exchange rate at which it can sell all the pounds it expects to receive in each of the upcoming months? (7 marks) c) The owner of the SEC is concerned that - due to Covid-19 pandemic and the Brexit related uncertainty - the pound may depreciate substantially over the next month. She also believes that the pound could appreciate substantially if inverse specific situations occur. Should she use currency futures or currency options to hedge the exchange rate risk? Is there any disadvantage of selecting this method for hedging? (6 marks) Question 2 - A Small Business Dilemma (10 marks) A Sports Exports Company (shortly called SEC) receives pounds each month as payment for the footballs that it exports. It anticipates that the pound will depreciate over time against the dollar. a) How can the SEC use currency futures contracts to hedge against exchange rate risk? Are there any limitations of using currency futures contracts that would prevent the Sports Exports Company from locking in a specific exchange rate at which it can sell all the pounds it expects to receive in each of the upcoming months? (7 marks) b) How can the SEC use currency options to hedge against exchange rate risk? Are there any limitations of using currency options contracts that would prevent the Sports Exports Company from locking in a specific exchange rate at which it can sell all the pounds it expects to receive in each of the upcoming months? (7 marks) c) The owner of the SEC is concerned that - due to Covid-19 pandemic and the Brexit related uncertainty - the pound may depreciate substantially over the next month. She also believes that the pound could appreciate substantially if inverse specific situations occur. Should she use currency futures or currency options to hedge the exchange rate risk? Is there any disadvantage of selecting this method for hedging? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts