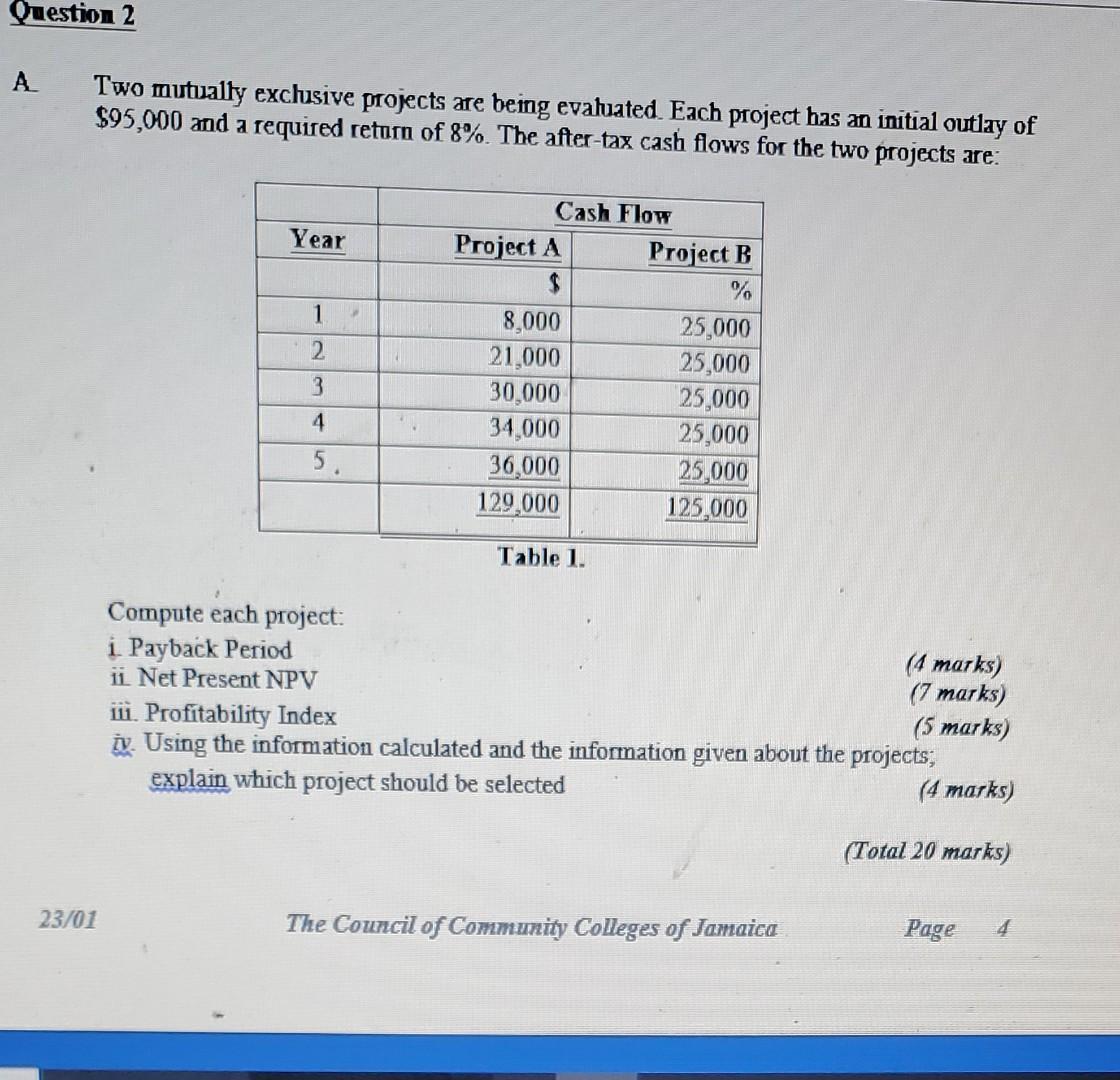

Question: Question 2 A Two mutually exclusive projects are being evaluated. Each project has an initial outlay of $95,000 and a required return of 8%.

Question 2 A Two mutually exclusive projects are being evaluated. Each project has an initial outlay of $95,000 and a required return of 8%. The after-tax cash flows for the two projects are: 23/01 Year 1 2 3 4 5. Compute each project: i. Payback Period ii. Net Present NPV Cash Flow Project A $ 8,000 21,000 30,000 34,000 36,000 129,000 Table 1. Project B % 25,000 25,000 25,000 25,000 25,000 125,000 (4 marks) (7 marks) (5 marks) iii. Profitability Index iv. Using the information calculated and the information given about the projects; explain which project should be selected (4 marks) (Total 20 marks) The Council of Community Colleges of Jamaica Page 4

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Answer Step 1 I NPV is increase the firm value ... View full answer

Get step-by-step solutions from verified subject matter experts