Question: QUESTION 2. A U.S. investor is planning to do some speculation in the foreign exchange market. a) Define speculation. Briefly describe how an investor might

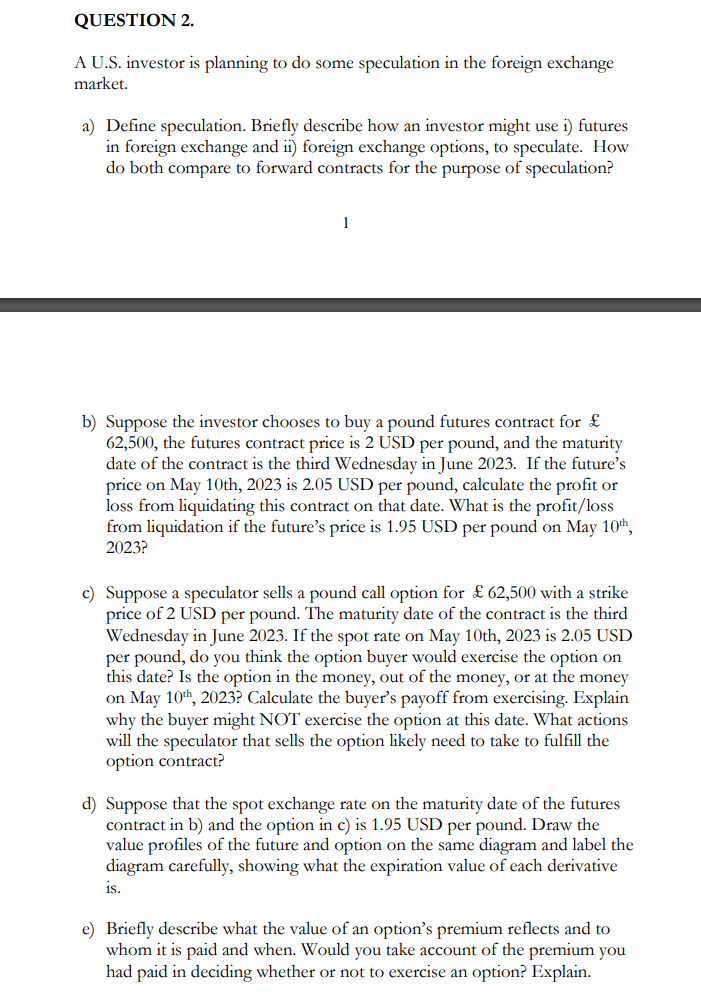

QUESTION 2. A U.S. investor is planning to do some speculation in the foreign exchange market. a) Define speculation. Briefly describe how an investor might use i) futures in foreign exchange and ii) foreign exchange options, to speculate. How do both compare to forward contracts for the purpose of speculation? 1 b) Suppose the investor chooses to buy a pound futures contract for 62,500 , the futures contract price is 2 USD per pound, and the maturity date of the contract is the third Wednesday in June 2023. If the future's price on May 10th, 2023 is 2.05 USD per pound, calculate the profit or loss from liquidating this contract on that date. What is the profit/loss from liquidation if the future's price is 1.95 USD per pound on May 10th, 2023? c) Suppose a speculator sells a pound call option for 62,500 with a strike price of 2 USD per pound. The maturity date of the contract is the third Wednesday in June 2023. If the spot rate on May 10th, 2023 is 2.05 USD per pound, do you think the option buyer would exercise the option on this date? Is the option in the money, out of the money, or at the money on May 10th,2023 ? Calculate the buyer's payoff from exercising. Explain why the buyer might NOT exercise the option at this date. What actions will the speculator that sells the option likely need to take to fulfill the option contract? d) Suppose that the spot exchange rate on the maturity date of the futures contract in b) and the option in c) is 1.95 USD per pound. Draw the value profiles of the future and option on the same diagram and label the diagram carefully, showing what the expiration value of each derivative is. e) Briefly describe what the value of an option's premium reflects and to whom it is paid and when. Would you take account of the premium you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts