Question: Question 2 (a) What are the risks an investor would face when making an investment in corporate bonds? (10 marks) (b) An investor is considering

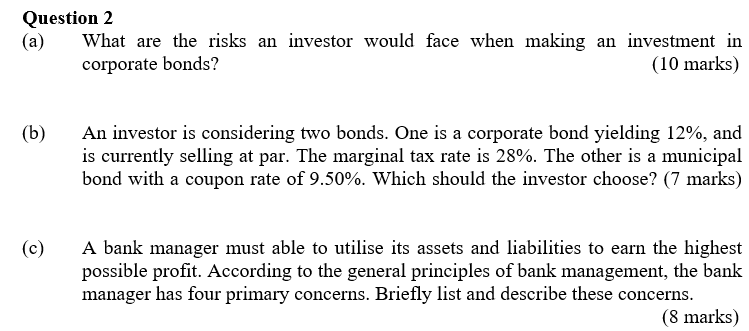

Question 2 (a) What are the risks an investor would face when making an investment in corporate bonds? (10 marks) (b) An investor is considering two bonds. One is a corporate bond yielding 12%, and is currently selling at par. The marginal tax rate is 28%. The other is a municipal bond with a coupon rate of 9.50%. Which should the investor choose? (7 marks) (c) A bank manager must able to utilise its assets and liabilities to earn the highest possible profit. According to the general principles of bank management, the bank manager has four primary concerns. Briefly list and describe these concerns. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts