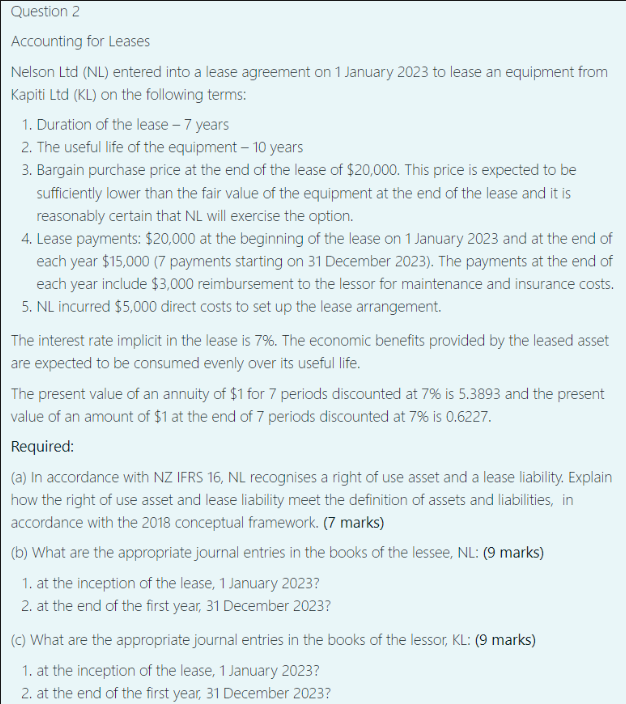

Question: Question 2 Accounting for Leases Nelson Ltd ( NL ) entered into a lease agreement on 1 January 2 0 2 3 to lease an

Question

Accounting for Leases

Nelson Ltd NL entered into a lease agreement on January to lease an equipment from

Kapiti Ltd KL on the following terms:

Duration of the lease years

The useful life of the equipment years

Bargain purchase price at the end of the lease of $ This price is expected to be

sufficiently lower than the fair value of the equipment at the end of the lease and it is

reasonably certain that NL will exercise the option.

Lease payments: $ at the beginning of the lease on January and at the end of

each year $ payments starting on December The payments at the end of

each year include $ reimbursement to the lessor for maintenance and insurance costs.

NL incurred $ direct costs to set up the lease arrangement.

The interest rate implicit in the lease is The economic benefits provided by the leased asset

are expected to be consumed evenly over its useful life.

The present value of an annuity of $ for periods discounted at is and the present

value of an amount of $ at the end of periods discounted at is

Required:

a In accordance with NZ IFRS NL recognises a right of use asset and a lease liability. Explain

how the right of use asset and lease liability meet the definition of assets and liabilities, in

accordance with the conceptual framework. marks

b What are the appropriate journal entries in the books of the lessee, NL: marks

at the inception of the lease, January

at the end of the first year, December

c What are the appropriate journal entries in the books of the lessor, KL: marks

at the inception of the lease, January

at the end of the first year, December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock