Question: Question 2: Applications (60 points) Suppose that you have just started your first job as a junior investment analyst at a hedge fund. You have

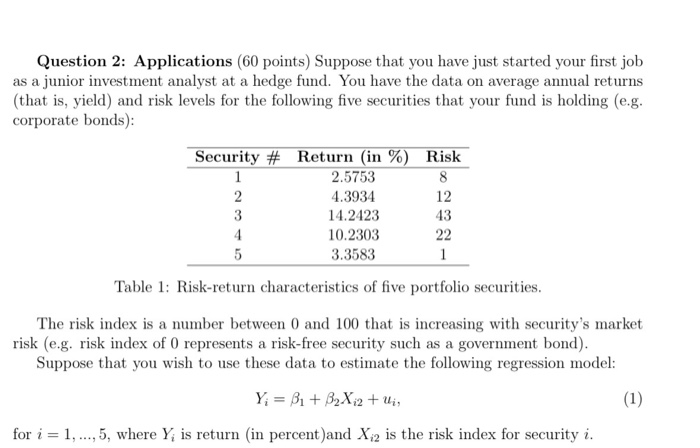

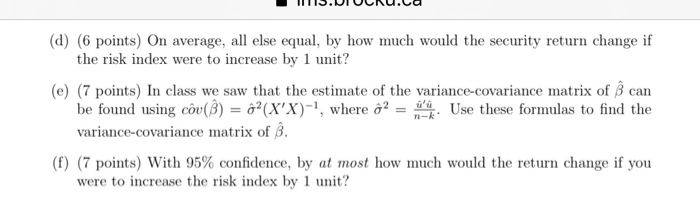

Question 2: Applications (60 points) Suppose that you have just started your first job as a junior investment analyst at a hedge fund. You have the data on average annual returns (that is, yield) and risk levels for the following five securities that your fund is holding (e.g. corporate bonds): Security # Return (in %) Risk 2.5753 4.3934 14.2423 43 10.2303 3.3583 Table 1: Risk-return characteristics of five portfolio securities. The risk index is a number between 0 and 100 that is increasing with security's market risk (e.g. risk index of 0 represents a risk-free security such as a government bond). Suppose that you wish to use these data to estimate the following regression model: Y; = B1 + B2X 2 + Ui, (1) for i = 1, ...,5, where Y is return (in percent and X/2 is the risk index for security i. 115.UIUCNu.ca (d) (6 points) On average, all else equal, by how much would the security return change if the risk index were to increase by 1 unit? (e) (7 points) In class we saw that the estimate of the variance-covariance matrix of 8 can be found using c(B) = (X'X)-1, where 2 = 'u. Use these formulas to find the variance-covariance matrix of . (f) (7 points) With 95% confidence, by at most how much would the return change if you were to increase the risk index by 1 unit? Question 2: Applications (60 points) Suppose that you have just started your first job as a junior investment analyst at a hedge fund. You have the data on average annual returns (that is, yield) and risk levels for the following five securities that your fund is holding (e.g. corporate bonds): Security # Return (in %) Risk 2.5753 4.3934 14.2423 43 10.2303 3.3583 Table 1: Risk-return characteristics of five portfolio securities. The risk index is a number between 0 and 100 that is increasing with security's market risk (e.g. risk index of 0 represents a risk-free security such as a government bond). Suppose that you wish to use these data to estimate the following regression model: Y; = B1 + B2X 2 + Ui, (1) for i = 1, ...,5, where Y is return (in percent and X/2 is the risk index for security i. 115.UIUCNu.ca (d) (6 points) On average, all else equal, by how much would the security return change if the risk index were to increase by 1 unit? (e) (7 points) In class we saw that the estimate of the variance-covariance matrix of 8 can be found using c(B) = (X'X)-1, where 2 = 'u. Use these formulas to find the variance-covariance matrix of . (f) (7 points) With 95% confidence, by at most how much would the return change if you were to increase the risk index by 1 unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts