Question: Question 2: Assume an excise tax that has caused a decrease in Supply Assume the old equilibrium before tax remains the same, but now assume

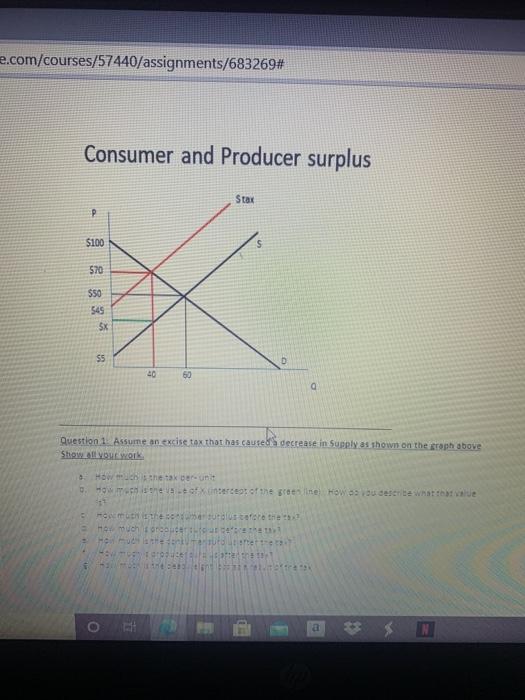

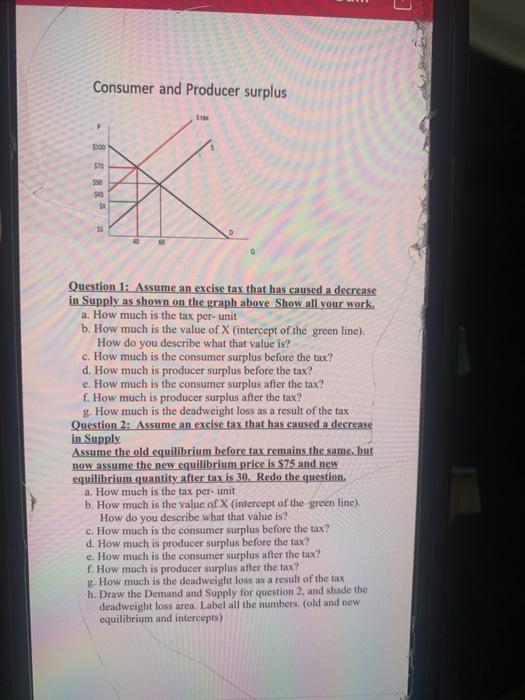

Question 2: Assume an excise tax that has caused a decrease in Supply Assume the old equilibrium before tax remains the same, but now assume the new equilibrium price is $75 and new equilibrium quantity after tax is 30. Redo the question. a. How much is the tax per- unit b. How much is the value of X (intercept of the green line). How do you describe what that value is? c. How much is the consumer surplus before the tax? d. How much is producer surplus before the tax? e. How much is the consumer surplus after the tax? f. How much is producer surplus after the tax? g. How much is the deadweight loss as a result of the tax h. Draw the Demand and Supply for question 2, and shade the deadweight loss area. Label all the numbers. (old and new equilibrium and intercepts) e.com/courses/57440/assignments/683269# Consumer and Producer surplus Stax P $100 570 $50 545 SX SS D 40 50 Question 1. Assume an excise tax that has caused a decrease in Supply as shown on the graph above Show VOC Wk HOW the Unit 0. How much is the contents of the greenline Howes ou describe what out the outcome the How much for the Hot Tutte Het a Consumer and Producer surplus 5100 59 30 2 Question 1: Assume an excise tax that has caused a decrease in Supply as shown on the graph above Show all your work, a. How much is the tax per-unit b. How much is the value of X (intercept of the green line). How do you describe what that value is? c. How much is the consumer surplus before the tax? d. How much is producer surplus before the tax? e. How much is the consumer surplus after the tax? f. How much is producer surplus after the tax? g. How much is the deadweight loss as a result of the tax Question 2: Assume an excise tax that has caused a decrease in Supply Assume the old equilibrium before tax remains the same, but now assume the new equilibrium price is $75 and new equilibrium quantity after tax is 30. Redo the question. a. How much is the tax per-unit b. How much is the value of X (intercept of the green line) How do you describe what that value is? c. How much is the consumer surplus before the tax? d. How much is producer surplus before the tax? e. How much is the consumer surplus after the tax? f. How much is producer surplus after the tax? g. How much is the deadweight loss as a result of the tax h. Draw the Demand and Supply for question 2, and shade the deadweight loss area. Label all the numbers, cold and new equilibrium and intercepts) Question 2: Assume an excise tax that has caused a decrease in Supply Assume the old equilibrium before tax remains the same, but now assume the new equilibrium price is $75 and new equilibrium quantity after tax is 30. Redo the question. a. How much is the tax per- unit b. How much is the value of X (intercept of the green line). How do you describe what that value is? c. How much is the consumer surplus before the tax? d. How much is producer surplus before the tax? e. How much is the consumer surplus after the tax? f. How much is producer surplus after the tax? g. How much is the deadweight loss as a result of the tax h. Draw the Demand and Supply for question 2, and shade the deadweight loss area. Label all the numbers. (old and new equilibrium and intercepts) e.com/courses/57440/assignments/683269# Consumer and Producer surplus Stax P $100 570 $50 545 SX SS D 40 50 Question 1. Assume an excise tax that has caused a decrease in Supply as shown on the graph above Show VOC Wk HOW the Unit 0. How much is the contents of the greenline Howes ou describe what out the outcome the How much for the Hot Tutte Het a Consumer and Producer surplus 5100 59 30 2 Question 1: Assume an excise tax that has caused a decrease in Supply as shown on the graph above Show all your work, a. How much is the tax per-unit b. How much is the value of X (intercept of the green line). How do you describe what that value is? c. How much is the consumer surplus before the tax? d. How much is producer surplus before the tax? e. How much is the consumer surplus after the tax? f. How much is producer surplus after the tax? g. How much is the deadweight loss as a result of the tax Question 2: Assume an excise tax that has caused a decrease in Supply Assume the old equilibrium before tax remains the same, but now assume the new equilibrium price is $75 and new equilibrium quantity after tax is 30. Redo the question. a. How much is the tax per-unit b. How much is the value of X (intercept of the green line) How do you describe what that value is? c. How much is the consumer surplus before the tax? d. How much is producer surplus before the tax? e. How much is the consumer surplus after the tax? f. How much is producer surplus after the tax? g. How much is the deadweight loss as a result of the tax h. Draw the Demand and Supply for question 2, and shade the deadweight loss area. Label all the numbers, cold and new equilibrium and intercepts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts