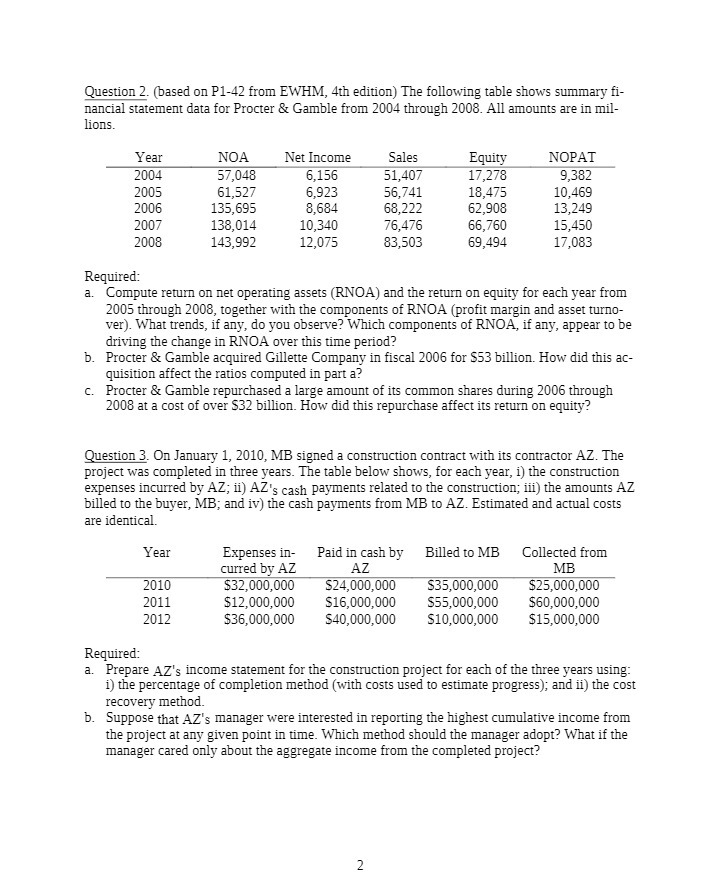

Question: Question 2. {based on P1-42 from EWHM, 4th edition} The following table shows summary - nancial statement data for Procter 5: Gamble from 2994 through

Question 2. {based on P1-42 from EWHM, 4th edition} The following table shows summary - nancial statement data for Procter 5: Gamble from 2994 through 2999. Pail amounts are in mil lions. Year N021 Net Income Sales Equity NDPAT 2994 52,945 5, 155 5 1,492 1 2,2 29 9,352 2995 51,5 22 5,923 55,241 15,425 19,459 2995 135,595 9,594 59, 222 52,999 13,249 2992 139,914 19, 349 25,425 55, 259 13,459 2995 143,992 12,925 93, 593 59,494 12,953 Required: a. lCompute return on net operating assets [RN09] and the return on equity for each year from 2995 through 2995, together with the components of RN09. [prot margin and asset turno ver]. What trends, if any, do you observe? E'Jhich components of Eli-IDA, if any, appear to be driving the change in RN09. over this time period? b. Procter 5: lGamble acquired Gillette Company in scal 2995 for 553 billion. How did this ac- quisition affect the ratios computed in part a? c. Procter 5: lGamble repurchased a large amount of its common shares during 2995 through 2999 at a cost of over 532 billion. How did this repurchase affect its return on equity? Qgestion 3. On January 1, 2919, ME signed a construction contract with im contractor 212.. The project was completed in three years. The table below shows, for each year, i} the consn'uction expenses incurred by 11.2; ii} Al's cash payments related to the construction; iii] the amounts 112 billed to the buyer, ME; and iv] the cash payments from ME to .92.. Esthuated and actual costs are identical. Year Expenses in Paid in cash by Billed to ME Collected from curred by 92. 2'13 ME- 2919 $32,999,999 524,999,999 53 5,999,999 $25,999,999 2911 $12,999,999 515,999,999 55 5,999,999 $59,999,999 2912 $35,999,999 549,999,999 519,999,999 $15,999,999 Required: a. Prepare 212's income statement for the construction project for each of the three years using: i] the percentage of completion method [with costs used to estimate progress), and ii] the cost recovery method. b. Suppose that 113's manager were interested in reporting the highest cumulative income from the project at any given point in time. Which method should the manager adopt?I What if the manager cared only about the aggregate income from the completed project