Question: QUESTION 2 BHP Ltd has a mining opportunity with a life of 3 years. In order to exploit the mining opportunity, the company will have

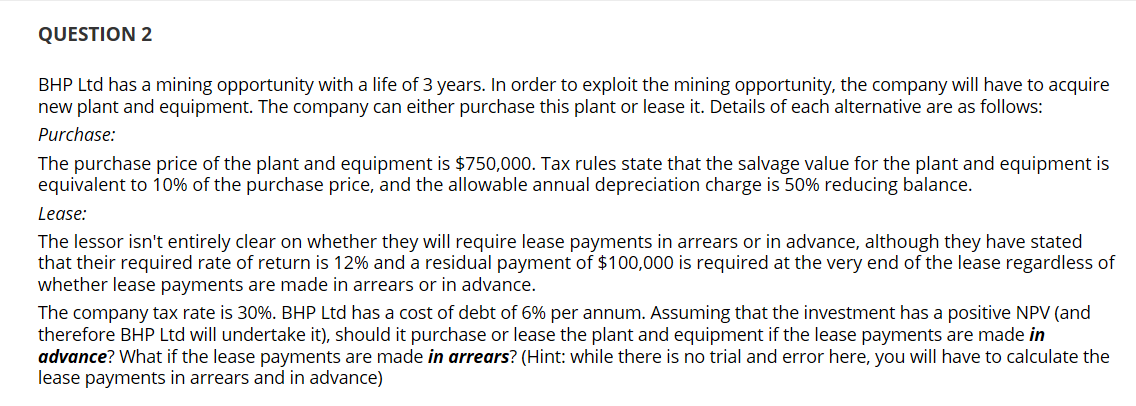

QUESTION 2 BHP Ltd has a mining opportunity with a life of 3 years. In order to exploit the mining opportunity, the company will have to acquire new plant and equipment. The company can either purchase this plant or lease it. Details of each alternative are as follows: Purchase: The purchase price of the plant and equipment is $750,000. Tax rules state that the salvage value for the plant and equipment is equivalent to 10% of the purchase price, and the allowable annual depreciation charge is 50% reducing balance. Lease: The lessor isn't entirely clear on whether they will require lease payments in arrears or in advance, although they have stated that their required rate of return is 12% and a residual payment of $100,000 is required at the very end of the lease regardless of whether lease payments are made in arrears or in advance. The company tax rate is 30%. BHP Ltd has a cost of debt of 6% per annum. Assuming that the investment has a positive NPV (and therefore BHP Ltd will undertake it), should it purchase or lease the plant and equipment if the lease payments are made in advance? What if the lease payments are made in arrears? (Hint: while there is no trial and error here, you will have to calculate the lease payments in arrears and in advance)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts