Question: 3G 0 100% 11:33 Edit 3 Question 1 (12 Marks) Vulcan Foundries Limited is evaluating two offers by equipment vendors, Chilungu Enterprise and Shepherd Alloys,

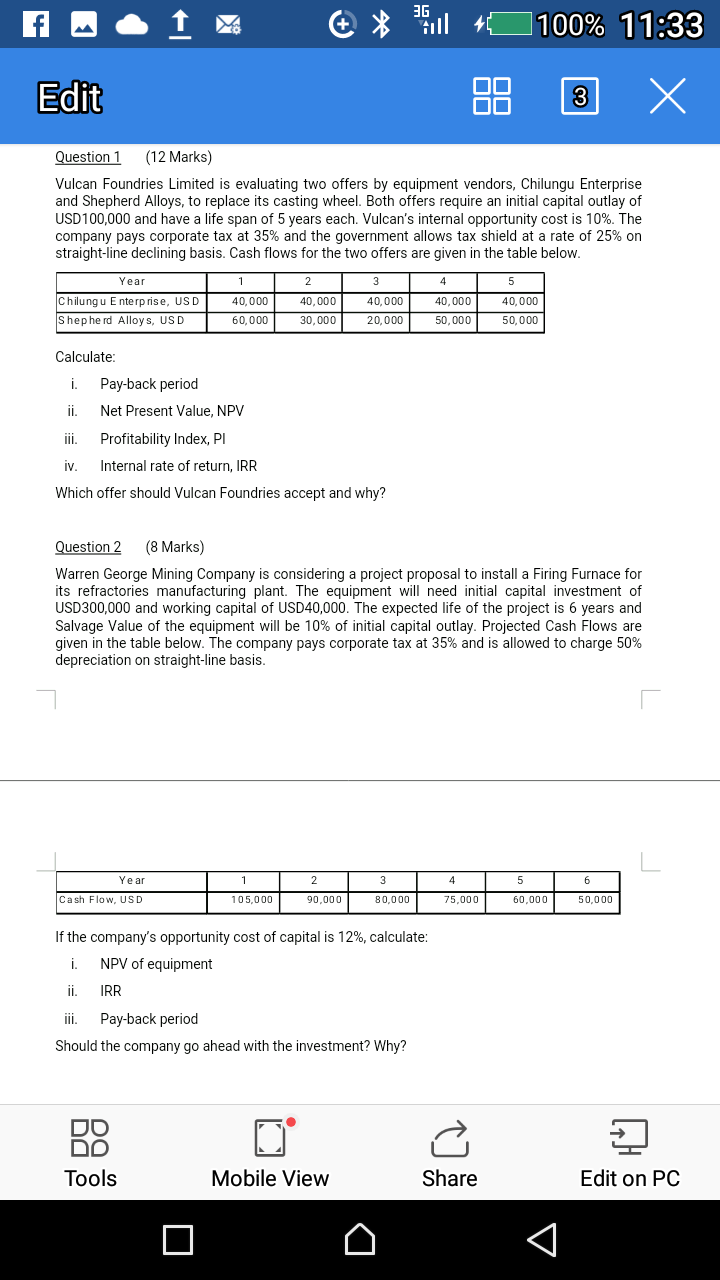

3G 0 100% 11:33 Edit 3 Question 1 (12 Marks) Vulcan Foundries Limited is evaluating two offers by equipment vendors, Chilungu Enterprise and Shepherd Alloys, to replace its casting wheel. Both offers require an initial capital outlay of USD 100,000 and have a life span of 5 years each. Vulcan's internal opportunity cost is 10%. The company pays corporate tax at 35% and the government allows tax shield at a rate of 25% on straight-line declining basis. Cash flows for the two offers are given in the table below. Year 2 3 4 5 1 40,000 40,000 40,000 Chilungu Enterprise, USD Shepherd Alloys, USD 40,000 30,000 40.000 50,000 60,000 20,000 50,000 Calculate: i. Pay-back period il Net Present Value, NPV Profitability Index, PI iv. Internal rate of return, IRR Which offer should Vulcan Foundries accept and why? Question 2 (8 Marks) Warren George Mining Company is considering a project proposal to install a Firing Furnace for its refractories manufacturing plant. The equipment will need initial capital investment of USD300,000 and working capital of USD40,000. The expected life of the project is 6 years and Salvage Value of the equipment will be 10% of initial capital outlay. Projected Cash Flows are given in the table below. The company pays corporate tax at 35% and is allowed to charge 50% depreciation on straight-line basis. Year 2 3 4 5 6 Cash Flow, USD 105,000 90,000 80,000 75,000 60,000 50,000 If the company's opportunity cost of capital is 12%, calculate: NPV of equipment IRR i. ii. iii. Pay-back period Should the company go ahead with the investment? Why? Tools Mobile View Share Edit on PC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts