Question: Question 2: Binomial Option Pricing (3/10) A/ share in the company no dividends (ND) currently trades at $80. The volatility of the stock price is

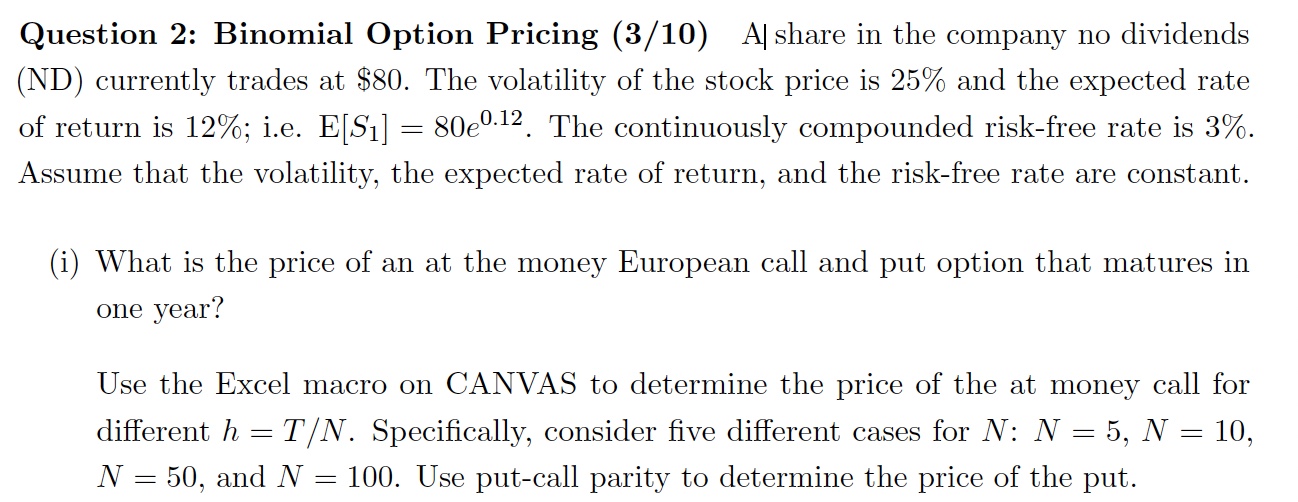

Question 2: Binomial Option Pricing (3/10) A/ share in the company no dividends (ND) currently trades at $80. The volatility of the stock price is 25% and the expected rate of return is 12%; i.e. E[S1]=80e0.12. The continuously compounded risk-free rate is 3%. Assume that the volatility, the expected rate of return, and the risk-free rate are constant. (i) What is the price of an at the money European call and put option that matures in one year? Use the Excel macro on CANVAS to determine the price of the at money call for different h=T/N. Specifically, consider five different cases for N:N=5,N=10, N=50, and N=100. Use put-call parity to determine the price of the put. (ii) What is the price of an American at-the-money put that matures in one year? (ii.a) Use the Excel macro on CANVAS to determine the price of the American put. Choose N=100. (ii.b) Compare the price of the American put to the price of the European put. Explain intuitively why somebody would like to exercise an American put early. (iii) Show that it is never optimal to exercise a call on a non-dividend paying stock early without making any assumptions about the movements of the stock. Question 2: Binomial Option Pricing (3/10) A/ share in the company no dividends (ND) currently trades at $80. The volatility of the stock price is 25% and the expected rate of return is 12%; i.e. E[S1]=80e0.12. The continuously compounded risk-free rate is 3%. Assume that the volatility, the expected rate of return, and the risk-free rate are constant. (i) What is the price of an at the money European call and put option that matures in one year? Use the Excel macro on CANVAS to determine the price of the at money call for different h=T/N. Specifically, consider five different cases for N:N=5,N=10, N=50, and N=100. Use put-call parity to determine the price of the put. (ii) What is the price of an American at-the-money put that matures in one year? (ii.a) Use the Excel macro on CANVAS to determine the price of the American put. Choose N=100. (ii.b) Compare the price of the American put to the price of the European put. Explain intuitively why somebody would like to exercise an American put early. (iii) Show that it is never optimal to exercise a call on a non-dividend paying stock early without making any assumptions about the movements of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts