Question: AaBbCcDdE AaBbCcDdE AaBbcdl AaBbCcD Normal No Spacing Heading 1 Heading 2 . 112 + 6071 1. Construct a profit and loss diagram (chart) for an

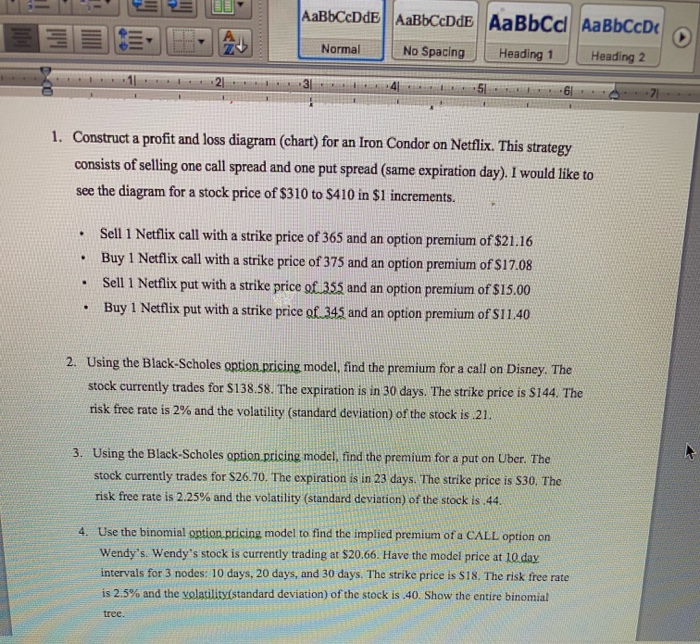

AaBbCcDdE AaBbCcDdE AaBbcdl AaBbCcD Normal No Spacing Heading 1 Heading 2 . 112 + 6071 1. Construct a profit and loss diagram (chart) for an Iron Condor on Netflix. This strategy consists of selling one call spread and one put spread (same expiration day). I would like to see the diagram for a stock price of $310 to $410 in $1 increments. Sell 1 Netflix call with a strike price of 365 and an option premium of $21.16 . Buy 1 Netflix call with a strike price of 375 and an option premium of $17.08 Sell 1 Netflix put with a strike price of 355 and an option premium of $15.00 Buy 1 Netflix put with a strike price of_345 and an option premium of $11.40 2. Using the Black-Scholes option pricing model, find the premium for a call on Disney. The stock currently trades for $138.58. The expiration is in 30 days. The strike price is $144. The risk free rate is 2% and the volatility (standard deviation of the stock is 21. stock currently trades for S26.70. The expiration is in 23 days. The strike price is $30. The risk free rate is 2.25% and the volatility (standard deviation) of the stock is 44. 4. Use the binomial option pricing model to find the implied premium of a CALL option on Wendy's. Wendy's stock is currently trading at $20.66. Have the model price at 10 day. intervals for 3 nodes: 10 days, 20 days, and 30 days. The strike price is $18. The risk free rate is 2.5% and the volatility standard deviation) of the stock is 40. Show the entire binomial tree. AaBbCcDdE AaBbCcDdE AaBbcdl AaBbCcD Normal No Spacing Heading 1 Heading 2 . 112 + 6071 1. Construct a profit and loss diagram (chart) for an Iron Condor on Netflix. This strategy consists of selling one call spread and one put spread (same expiration day). I would like to see the diagram for a stock price of $310 to $410 in $1 increments. Sell 1 Netflix call with a strike price of 365 and an option premium of $21.16 . Buy 1 Netflix call with a strike price of 375 and an option premium of $17.08 Sell 1 Netflix put with a strike price of 355 and an option premium of $15.00 Buy 1 Netflix put with a strike price of_345 and an option premium of $11.40 2. Using the Black-Scholes option pricing model, find the premium for a call on Disney. The stock currently trades for $138.58. The expiration is in 30 days. The strike price is $144. The risk free rate is 2% and the volatility (standard deviation of the stock is 21. stock currently trades for S26.70. The expiration is in 23 days. The strike price is $30. The risk free rate is 2.25% and the volatility (standard deviation) of the stock is 44. 4. Use the binomial option pricing model to find the implied premium of a CALL option on Wendy's. Wendy's stock is currently trading at $20.66. Have the model price at 10 day. intervals for 3 nodes: 10 days, 20 days, and 30 days. The strike price is $18. The risk free rate is 2.5% and the volatility standard deviation) of the stock is 40. Show the entire binomial tree

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts