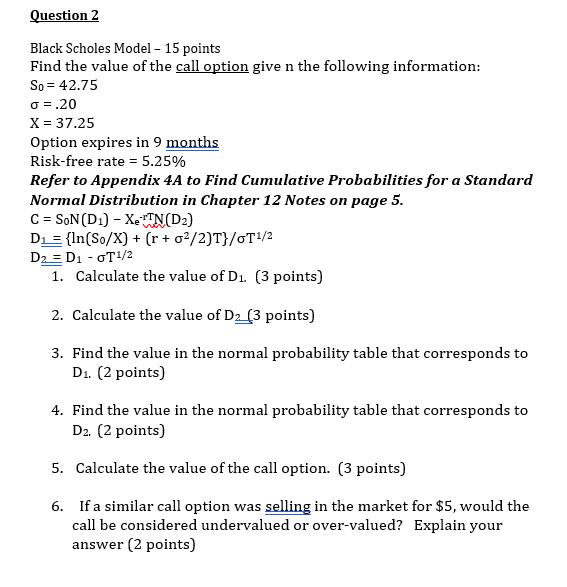

Question: Question 2 Black Scholes Model - 15 points Find the value of the call option give n the following information: S0=42.75=.20X=37.25 Option expires in 9

Question 2 Black Scholes Model - 15 points Find the value of the call option give n the following information: S0=42.75=.20X=37.25 Option expires in 9 months Risk-free rate =5.25% Refer to Appendix 4A to Find Cumulative Probabilities for a Standard Normal Distribution in Chapter 12 Notes on page 5. C=S0N(D1)XerTTN(D2)D1={ln(S0/X)+(r+2/2)T}/T1/2D2==D1T1/2 1. Calculate the value of D1. (3 points) 2. Calculate the value of D2(3 points) 3. Find the value in the normal probability table that corresponds to D1. (2 points) 4. Find the value in the normal probability table that corresponds to D2. (2 points) 5. Calculate the value of the call option. ( 3 points) 6. If a similar call option was selling in the market for $5, would the call be considered undervalued or over-valued? Explain your answer ( 2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts