Question: Question 2 Blackstone Energy is planning to issue two types of 25 year, non callable bonds to raise a total of 56 million. First, 3,000

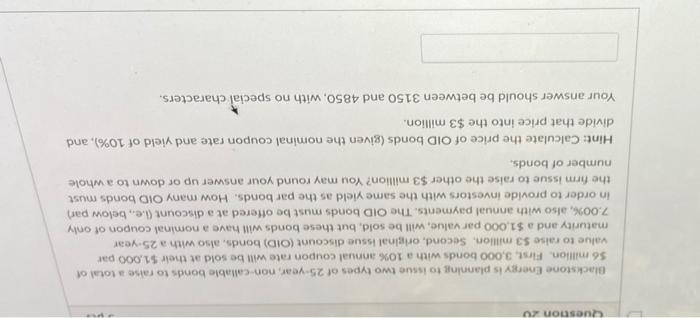

Question 2 Blackstone Energy is planning to issue two types of 25 year, non callable bonds to raise a total of 56 million. First, 3,000 bonds with a 10% annual coupon rate will be sold at their 51.000 par value to raise 53 million. Second, original issue discount (OID) bonds, also with a 25 year maturity and a $1,000 par value, will be sold, but these bonds will have a nominal coupon of only 7.00%, also with annual payments. The OID bonds must be offered at a discount (.e., below par in order to provide investors with the same yield as the par bonds. How many Old bonds must the firm issue to raise the other $3 million? You may round your answer up or down to a whole number of bonds. Hint: Calculate the price of OID bonds (given the nominal coupon rate and yield of 10%), and divide that price into the $3 million Your answer should be between 3150 and 4850, with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts