Question: Question 2 Buffalo Ltd. issues 8,700, $5 cumulative preferred shares at $62 each and 15,000 common shares at $30 each at the beginning of

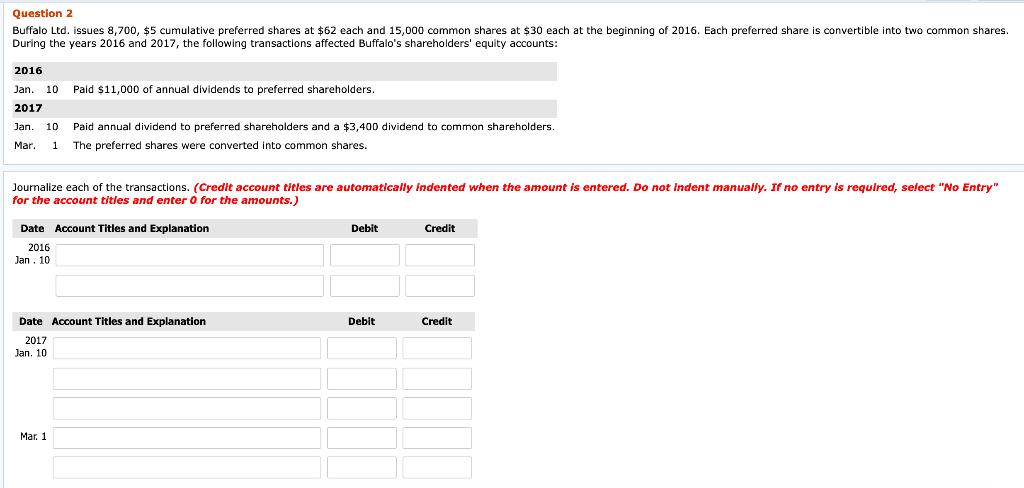

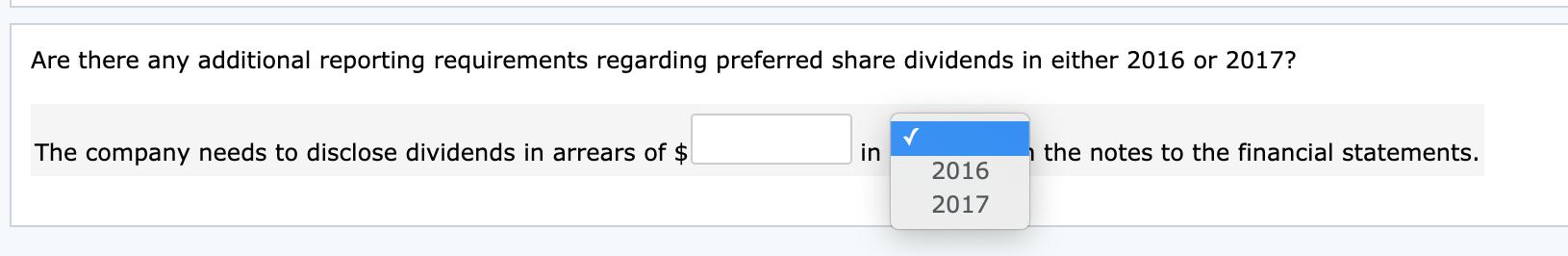

Question 2 Buffalo Ltd. issues 8,700, $5 cumulative preferred shares at $62 each and 15,000 common shares at $30 each at the beginning of 2016. Each preferred share is convertible into two common shares. During the years 2016 and 2017, the following transactions affected Buffalo's shareholders' equity accounts: 2016 Jan. 10 Paid $11,000 of annual dividends to preferred shareholders. 2017 Jan. 10 Paid annual dividend to preferred shareholders and a $3,400 dividend to common shareholders. Mar. 1 The preferred shares were converted into common shares. Journalize each of the transactions. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit 2016 J . 10 Date Account Titles and Explanation Debit Credit 2017 Jan. 10 Mar. 1 Are there any additional reporting requirements regarding preferred share dividends in either 2016 or 2017? The company needs to disclose dividends in arrears of $ in 1 the notes to the financial statements. 2016 2017

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Date Account Titles and Explanation Debit Credit 2016 Cash Dividends Preferred 11000 Jan... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635f6667ca3ae_231889.pdf

180 KBs PDF File

635f6667ca3ae_231889.docx

120 KBs Word File