Question: Question 2 : CAPM(capital Asset Pricing Model) You have recently been employed as a corporate finance advisor for the Platinum group ,who would like to

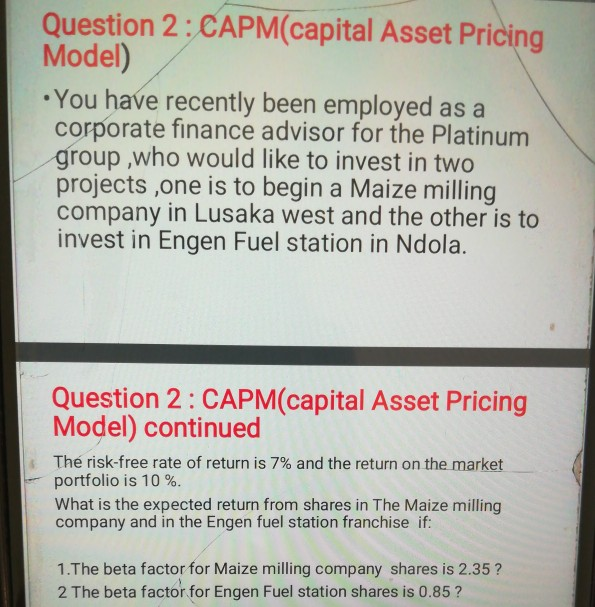

Question 2 : CAPM(capital Asset Pricing Model) You have recently been employed as a corporate finance advisor for the Platinum group ,who would like to invest in two projects ,one is to begin a Maize milling company in Lusaka west and the other is to invest in Engen Fuel station in Ndola. Question 2: CAPM(capital Asset Pricing Model) continued The risk-free rate of return is 7% and the return on the market portfolio is 10%. What is the expected return from shares in The Maize milling company and in the Engen fuel station franchise if: 1. The beta factor for Maize milling company shares is 2.35? 2 The beta factor for Engen Fuel station shares is 0.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts