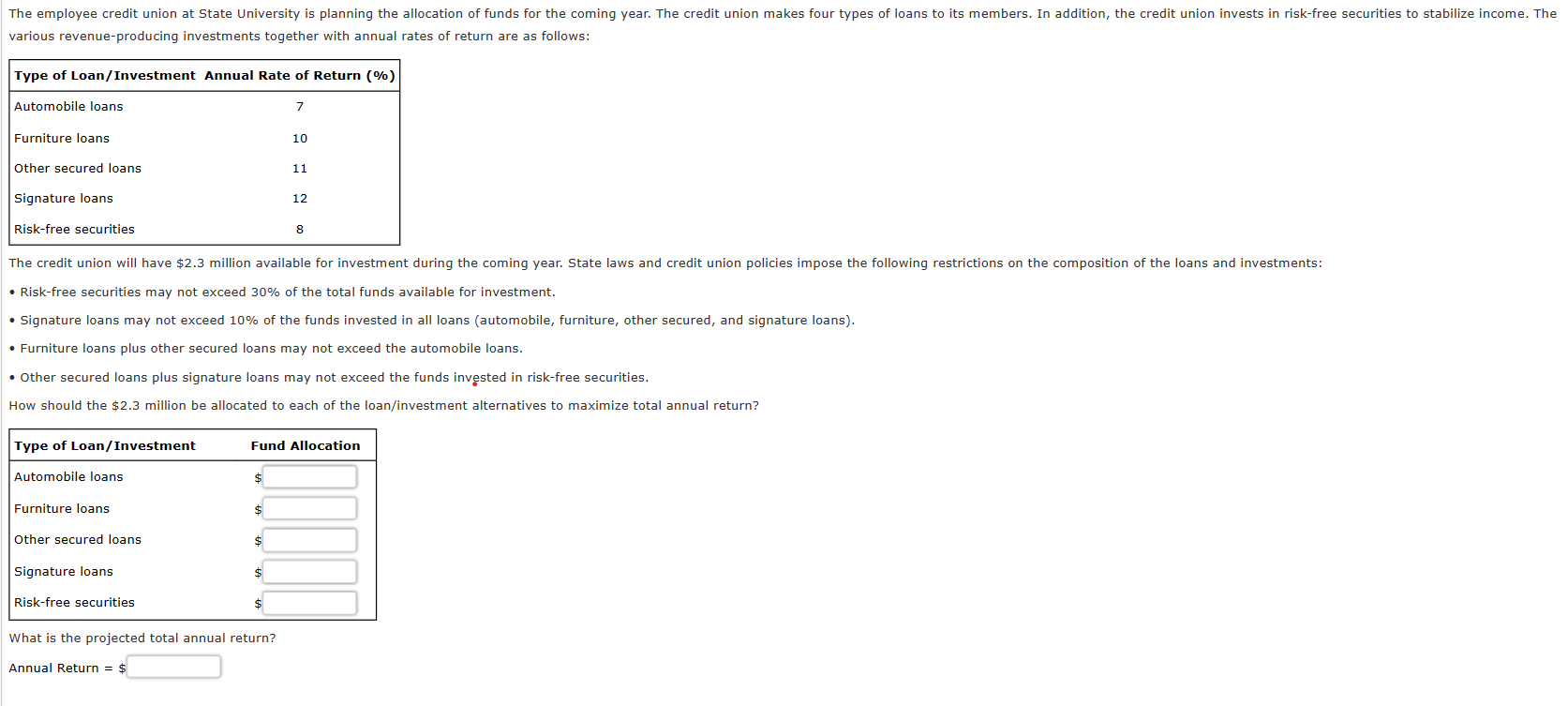

Question: Experts keep giving me wrong answers so I started the outline - Risk-free securities may not exceed 30% of the total funds available for investment.

Experts keep giving me wrong answers so I started the outline

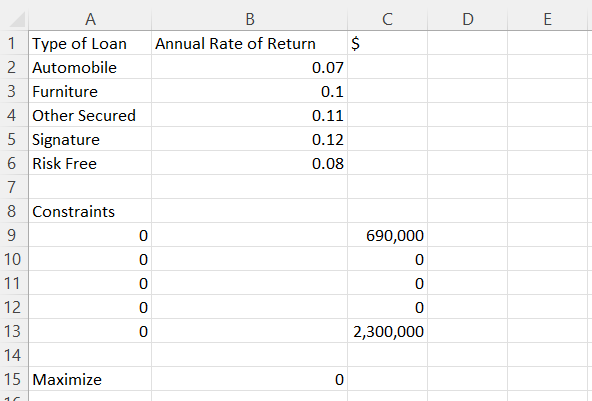

- Risk-free securities may not exceed 30% of the total funds available for investment. - Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans). - Furniture loans plus other secured loans may not exceed the automobile loans. - Other secured loans plus signature loans may not exceed the funds invsted in risk-free securities. How should the $2.3 million be allocated to each of the loan/investment alternatives to maximize total annual return? What is the projected total annual return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock