Question: Question 2. Catastrophe bonds are a relatively new asset class. One of the primary features of the security is that it is a zero beta

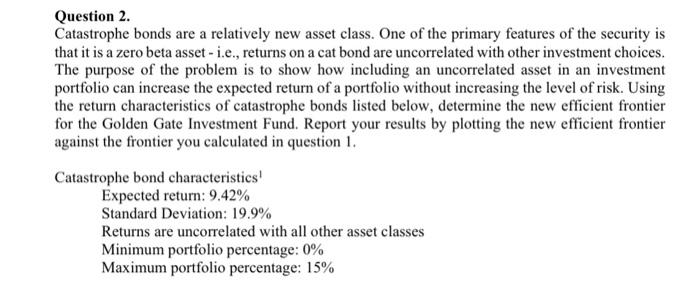

Question 2. Catastrophe bonds are a relatively new asset class. One of the primary features of the security is that it is a zero beta asset - i.e., returns on a cat bond are uncorrelated with other investment choices. The purpose of the problem is to show how including an uncorrelated asset in an investment portfolio can increase the expected return of a portfolio without increasing the level of risk. Using the return characteristics of catastrophe bonds listed below, determine the new efficient frontier for the Golden Gate Investment Fund. Report your results by plotting the new efficient frontier against the frontier you calculated in question 1. Catastrophe bond characteristics Expected return: 9.42% Standard Deviation: 19.9% Returns are uncorrelated with all other asset classes Minimum portfolio percentage: 0% Maximum portfolio percentage: 15% Question 2. Catastrophe bonds are a relatively new asset class. One of the primary features of the security is that it is a zero beta asset - i.e., returns on a cat bond are uncorrelated with other investment choices. The purpose of the problem is to show how including an uncorrelated asset in an investment portfolio can increase the expected return of a portfolio without increasing the level of risk. Using the return characteristics of catastrophe bonds listed below, determine the new efficient frontier for the Golden Gate Investment Fund. Report your results by plotting the new efficient frontier against the frontier you calculated in question 1. Catastrophe bond characteristics Expected return: 9.42% Standard Deviation: 19.9% Returns are uncorrelated with all other asset classes Minimum portfolio percentage: 0% Maximum portfolio percentage: 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts