Question: QUESTION 2 CHAPTER 9: ANNUAL DEPRECIATION AMOUNTS--STRAIGHT-LINE VS MACRS A machine costs $2,700,000 and qualifies as a 3-year business asset by the IRS. What is

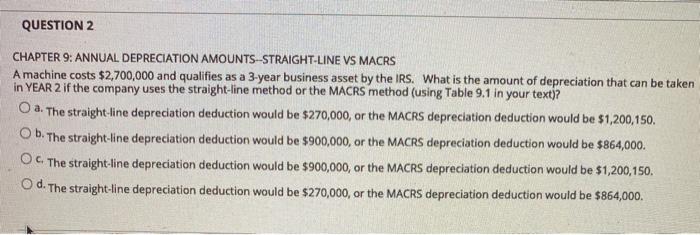

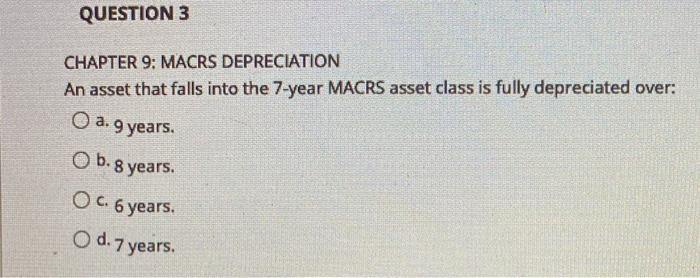

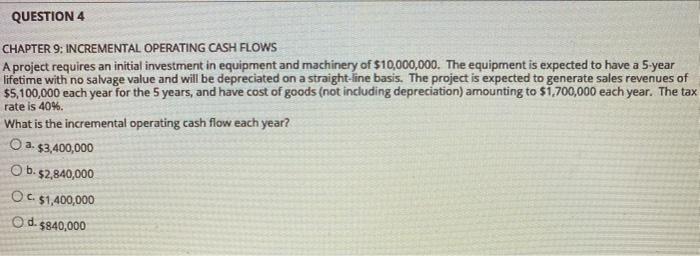

QUESTION 2 CHAPTER 9: ANNUAL DEPRECIATION AMOUNTS--STRAIGHT-LINE VS MACRS A machine costs $2,700,000 and qualifies as a 3-year business asset by the IRS. What is the amount of depreciation that can be taken in YEAR 2 if the company uses the straight-line method or the MACRS method (using Table 9.1 in your text)? O a. The straight-line depreciation deduction would be $270,000, or the MACRS depreciation deduction would be $1,200,150. Ob. The straight-line depreciation deduction would be $900,000, or the MACRS depreciation deduction would be $864,000. OC. The straight-line depreciation deduction would be $900,000, or the MACRS depreciation deduction would be $1,200,150. O d. The straight-line depreciation deduction would be $270,000, or the MACRS depreciation deduction would be $864,000. QUESTION 3 CHAPTER 9: MACRS DEPRECIATION An asset that falls into the 7-year MACRS asset class is fully depreciated over: O a. 9 years. b. 8 years. OC 6 years. O d. 7 years. QUESTION 4 CHAPTER 9: INCREMENTAL OPERATING CASH FLOWS A project requires an initial investment in equipment and machinery of $10,000,000. The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis. The project is expected to generate sales revenues of $5,100,000 each year for the 5 years, and have cost of goods (not including depreciation) amounting to $1,700,000 each year. The tax rate is 40%. What is the incremental operating cash flow each year? O a. $3,400,000 O b. 52,840,000 OC $1,400,000 Od $840,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts