Question: QUESTION 2 (CHAPTERS 2 & 4) Z Berhad is a pharmaceutical company involved in the manufacture of medicines and healthcare products. The company is planning

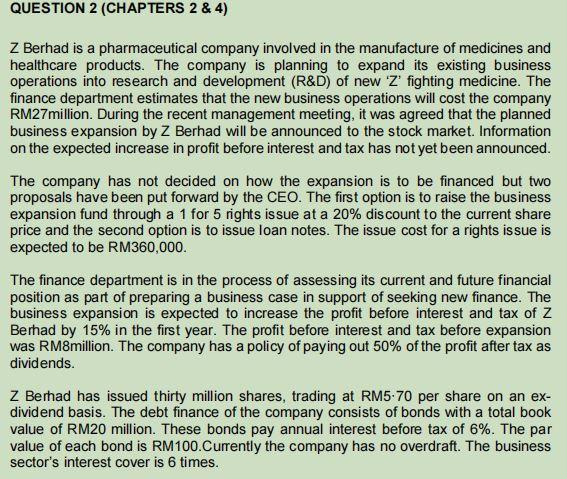

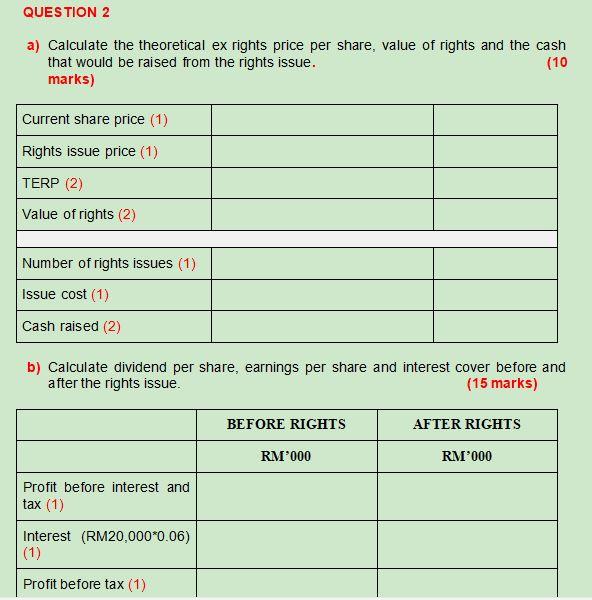

QUESTION 2 (CHAPTERS 2 & 4) Z Berhad is a pharmaceutical company involved in the manufacture of medicines and healthcare products. The company is planning to expand its existing business operations into research and development (R&D) of new 'Z' fighting medicine. The finance department estimates that the new business operations will cost the company RM27million. During the recent management meeting, it was agreed that the planned business expansion by z Berhad will be announced to the stock market. Information on the expected increase in profit before interest and tax has not yet been announced. The company has not decided on how the expansion is to be financed but two proposals have been put forward by the CEO. The first option is to raise the business expansion fund through a 1 for 5 nights issue at a 20% discount to the current share pri and the second option is to issue loan notes. The issue cost for a rights issue is expected to be RM360,000. The finance department is in the process of assessing its current and future financial position as part of preparing a business case in support of seeking new finance. The business expansion is expected to increase the profit before interest and tax of Z Berhad by 15% in the first year. The profit before interest and tax before expansion was RM8million. The company has a policy of paying out 50% of the profit after tax as dividends. Z Berhad has issued thirty million shares, trading at RM5-70 per share on an ex- dividend basis. The debt finance of the company consists of bonds with a total book value of RM20 million. These bonds pay annual interest before tax of 6%. The par value of each bond is RM100.Currently the company has no overdraft. The business sector's interest cover is 6 times. QUESTION 2 a) Calculate the theoretical ex rights price per share, value of rights and the cash that would be raised from the rights issue. (10 marks) Current share price (1) Rights issue price (1) TERP (2) Value of rights (2) Number of rights issues (1) Issue cost (1) Cash raised (2) b) Calculate dividend per share, earnings per share and interest cover before and after the rights issue. (15 marks) BEFORE RIGHTS AFTER RIGHTS RM'000 RM'000 Profit before interest and tax (1) Interest (RM20,000*0.06) (1) Profit before tax (1) Tax@20% (1) Profit after tax (1) Dividend 50% (1) Dividend per share (2) Number of shares (1) Earnings per share (sen) (3) Interest cover (3) + (C) Discuss the suggestion to finance the proposed expansion with a rights issue. (5 marks) QUESTION 2 (CHAPTERS 2 & 4) Z Berhad is a pharmaceutical company involved in the manufacture of medicines and healthcare products. The company is planning to expand its existing business operations into research and development (R&D) of new 'Z' fighting medicine. The finance department estimates that the new business operations will cost the company RM27million. During the recent management meeting, it was agreed that the planned business expansion by z Berhad will be announced to the stock market. Information on the expected increase in profit before interest and tax has not yet been announced. The company has not decided on how the expansion is to be financed but two proposals have been put forward by the CEO. The first option is to raise the business expansion fund through a 1 for 5 nights issue at a 20% discount to the current share pri and the second option is to issue loan notes. The issue cost for a rights issue is expected to be RM360,000. The finance department is in the process of assessing its current and future financial position as part of preparing a business case in support of seeking new finance. The business expansion is expected to increase the profit before interest and tax of Z Berhad by 15% in the first year. The profit before interest and tax before expansion was RM8million. The company has a policy of paying out 50% of the profit after tax as dividends. Z Berhad has issued thirty million shares, trading at RM5-70 per share on an ex- dividend basis. The debt finance of the company consists of bonds with a total book value of RM20 million. These bonds pay annual interest before tax of 6%. The par value of each bond is RM100.Currently the company has no overdraft. The business sector's interest cover is 6 times. QUESTION 2 a) Calculate the theoretical ex rights price per share, value of rights and the cash that would be raised from the rights issue. (10 marks) Current share price (1) Rights issue price (1) TERP (2) Value of rights (2) Number of rights issues (1) Issue cost (1) Cash raised (2) b) Calculate dividend per share, earnings per share and interest cover before and after the rights issue. (15 marks) BEFORE RIGHTS AFTER RIGHTS RM'000 RM'000 Profit before interest and tax (1) Interest (RM20,000*0.06) (1) Profit before tax (1) Tax@20% (1) Profit after tax (1) Dividend 50% (1) Dividend per share (2) Number of shares (1) Earnings per share (sen) (3) Interest cover (3) + (C) Discuss the suggestion to finance the proposed expansion with a rights issue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts