Question: Question 2 Consider the following ARMA(1,1)-ARCH(3) model, rt do + 01rt-1 + et + Q1et-1, et = Otzt, w+aje -1 +azet-2 +azet-3, (a) Derive the

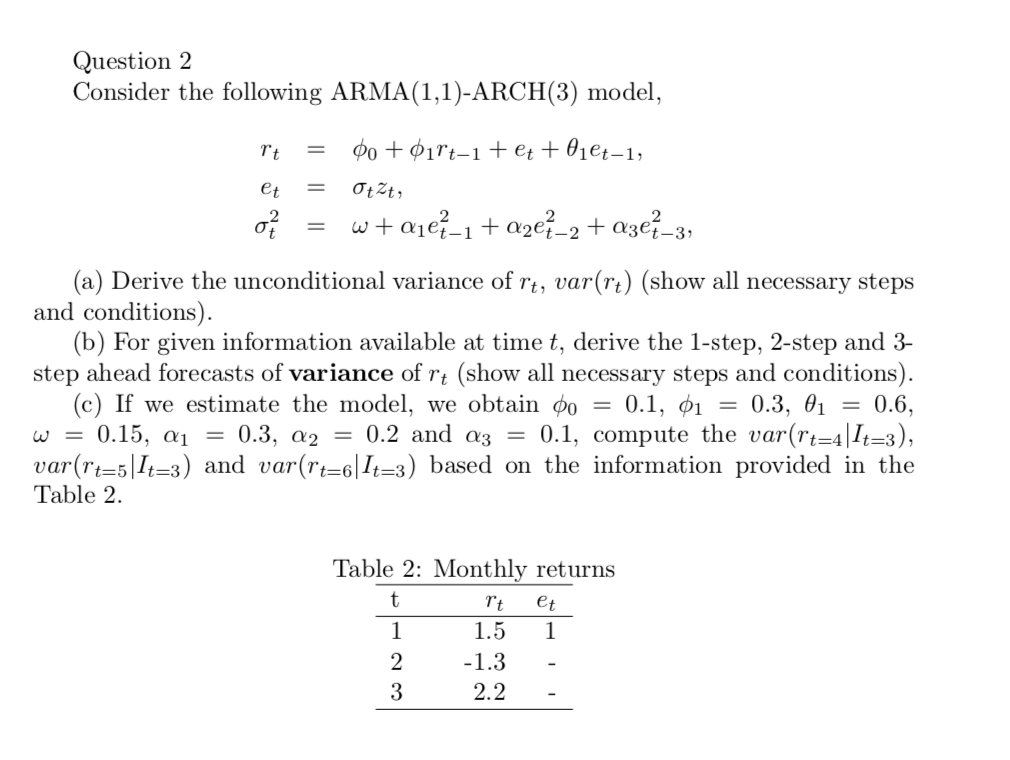

Question 2 Consider the following ARMA(1,1)-ARCH(3) model, rt do + 01rt-1 + et + Q1et-1, et = Otzt, w+aje -1 +azet-2 +azet-3, (a) Derive the unconditional variance of rt, var(rt) (show all necessary steps and conditions). (b) For given information available at time t, derive the 1-step, 2-step and 3- step ahead forecasts of variance of rt (show all necessary steps and conditions). (c) If we estimate the model, we obtain po = 0.1, 01 = 0.3, 01 = 0.6, 0.15, Q1 0.3, 02 0.2 and 03 0.1, compute the var(rt=4|1t=3), var(rt=5|It=3) and var(rt=6|I+=3) based on the information provided in the Table 2. W = Table 2: Monthly returns t rt et 1 1.5 1 CON -1.3 2.2 | Question 2 Consider the following ARMA(1,1)-ARCH(3) model, rt do + 01rt-1 + et + Q1et-1, et = Otzt, w+aje -1 +azet-2 +azet-3, (a) Derive the unconditional variance of rt, var(rt) (show all necessary steps and conditions). (b) For given information available at time t, derive the 1-step, 2-step and 3- step ahead forecasts of variance of rt (show all necessary steps and conditions). (c) If we estimate the model, we obtain po = 0.1, 01 = 0.3, 01 = 0.6, 0.15, Q1 0.3, 02 0.2 and 03 0.1, compute the var(rt=4|1t=3), var(rt=5|It=3) and var(rt=6|I+=3) based on the information provided in the Table 2. W = Table 2: Monthly returns t rt et 1 1.5 1 CON -1.3 2.2 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts