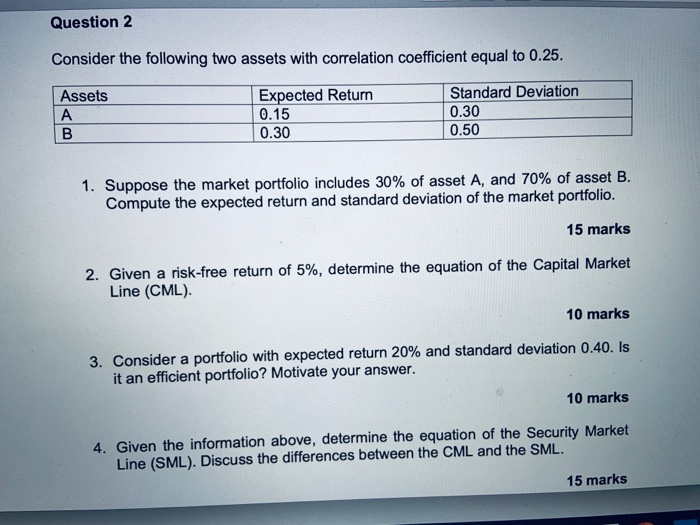

Question: Question 2 Consider the following two assets with correlation coefficient equal to 0.25. Assets A Expected Return 0.15 0.30 Standard Deviation 0.30 0.50 1. Suppose

Question 2 Consider the following two assets with correlation coefficient equal to 0.25. Assets A Expected Return 0.15 0.30 Standard Deviation 0.30 0.50 1. Suppose the market portfolio includes 30% of asset A, and 70% of asset B. Compute the expected return and standard deviation of the market portfolio. 15 marks 2. Given a risk-free return of 5%, determine the equation of the Capital Market Line (CML). 10 marks 3. Consider a portfolio with expected return 20% and standard deviation 0.40. Is it an efficient portfolio? Motivate your answer. 10 marks 4. Given the information above, determine the equation of the Security Market Line (SML). Discuss the differences between the CML and the SML. 15 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts