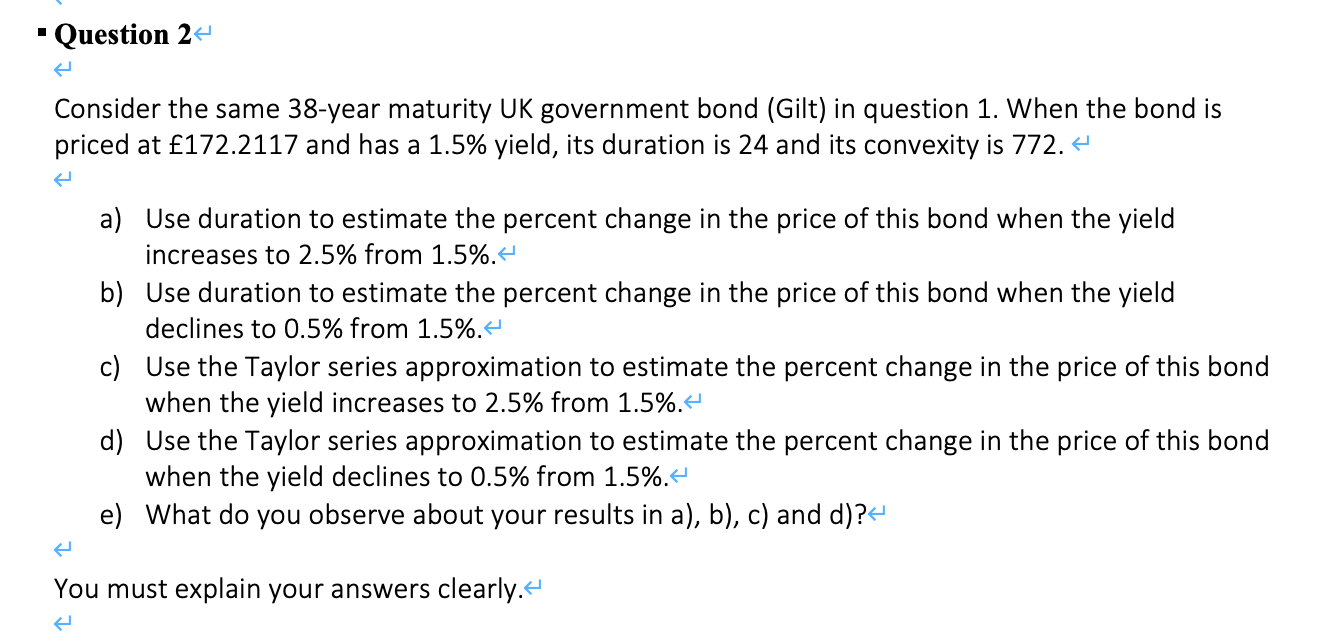

Question: Question 2 Consider the same 38-year maturity UK government bond (Gilt) in question 1. When the bond is priced at 172.2117 and has a 1.5%

Question 2 Consider the same 38-year maturity UK government bond (Gilt) in question 1. When the bond is priced at 172.2117 and has a 1.5% yield, its duration is 24 and its convexity is 772. 4 a) Use duration to estimate the percent change in the price of this bond when the yield increases to 2.5% from 1.5%. b) Use duration to estimate the percent change in the price of this bond when the yield declines to 0.5% from 1.5%. c) Use the Taylor series approximation to estimate the percent change in the price of this bond when the yield increases to 2.5% from 1.5%. d) Use the Taylor series approximation to estimate the percent change in the price of this bond when the yield declines to 0.5% from 1.5%.- e) What do you observe about your results in a), b), c) and d)?- You must explain your answers clearly." Question 2 Consider the same 38-year maturity UK government bond (Gilt) in question 1. When the bond is priced at 172.2117 and has a 1.5% yield, its duration is 24 and its convexity is 772. 4 a) Use duration to estimate the percent change in the price of this bond when the yield increases to 2.5% from 1.5%. b) Use duration to estimate the percent change in the price of this bond when the yield declines to 0.5% from 1.5%. c) Use the Taylor series approximation to estimate the percent change in the price of this bond when the yield increases to 2.5% from 1.5%. d) Use the Taylor series approximation to estimate the percent change in the price of this bond when the yield declines to 0.5% from 1.5%.- e) What do you observe about your results in a), b), c) and d)?- You must explain your answers clearly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts