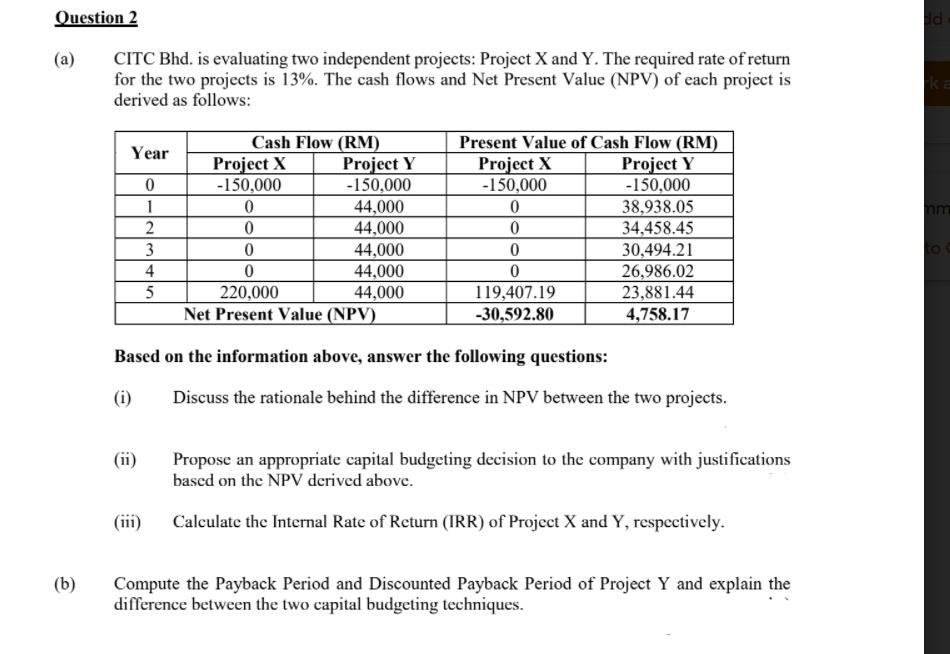

Question: Question 2 d (a) CITC Bhd. is evaluating two independent projects: Project X and Y. The required rate of return for the two projects is

Question 2 d (a) CITC Bhd. is evaluating two independent projects: Project X and Y. The required rate of return for the two projects is 13%. The cash flows and Net Present Value (NPV) of each project is derived as follows: Year 0 1 2 3 4 5 Cash Flow (RM) Project X Project Y -150,000 -150,000 0 44,000 0 44,000 0 44,000 0 44,000 220,000 44,000 Net Present Value (NPV) Present Value of Cash Flow (RM) Project X Project Y -150,000 -150,000 0 38,938.05 0 34,458.45 0 30,494.21 0 26,986.02 119,407.19 23,881.44 -30,592.80 4,758.17 Based on the information above, answer the following questions: (i) Discuss the rationale behind the difference in NPV between the two projects. Propose an appropriate capital budgeting decision to the company with justifications based on the NPV derived above. Calculate the Internal Rate of Return (IRR) of Project X and Y, respectively. (b) Compute the Payback Period and Discounted Payback Period of Project Y and explain the difference between the two capital budgeting techniques

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts