Question: QUESTION 2 (DERIVATIVE SECURITIES) a) A fund manager has been monitoring the performance of Virgin Galactic Corporation shares (NYSE: SPCE). The shares are currently trading

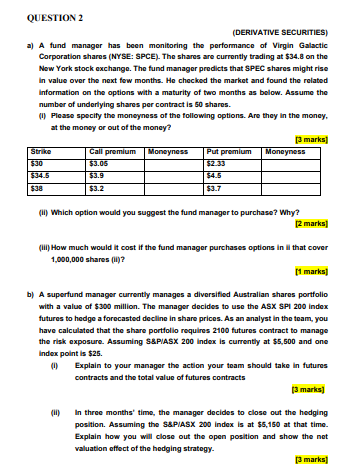

QUESTION 2 (DERIVATIVE SECURITIES) a) A fund manager has been monitoring the performance of Virgin Galactic Corporation shares (NYSE: SPCE). The shares are currently trading at $34.8 on the New York stock exchange. The fund manager predicts that SPEC shares might rise in value over the next few months. He checked the market and found the related Information on the options with a maturity of two months as below. Assume the number of underlying shares per contract is 50 shares. ) Please specify the moneyness of the following options. Are they in the money. at the money or out of the money? [3 marks Strike Cail premium Moneyness Put premium Moneyness 530 $3.06 54.5 $38 $3.2 $3.7 (II) Which option would you suggest the fund manager to purchase? Why? [2 marks] (III) How much would it cost if the fund manager purchases options in that cover 1,000,000 shares ( [1 marks] b) A superfund manager currently manages a diversified Australian shares portfolio with a value of $300 milion. The manager decides to use the ASX SPI 200 Index futures to hedge a forecasted decline in share prices. As an analyst in the team, you have calculated that the share portfolio requires 2100 futures contract to manage the risk exposure. Assuming S&PIASX 200 index is currently at $5,500 and one Index point is $25. (1) Explain to your manager the action your team should take in futures contracts and the total value of futures contracts [3 marks (11) In three months' time, the manager decides to close out the hedging position. Assuming the S&PIASX 200 Index is at $5,150 at that time. Explain how you will close out the open position and show the net valuation effect of the hedging strategy [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts