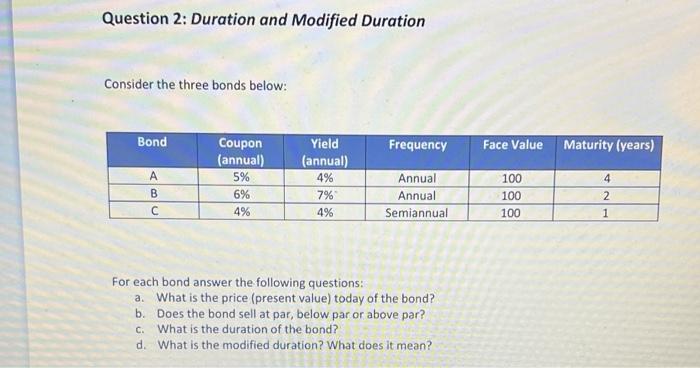

Question: Question 2: Duration and Modified Duration Consider the three bonds below: Bond Frequency Face Value Maturity (years) Coupon (annual) 5% 6% 4% A B Yield

Question 2: Duration and Modified Duration Consider the three bonds below: Bond Frequency Face Value Maturity (years) Coupon (annual) 5% 6% 4% A B Yield (annual) 4% 7% 4% 100 Annual Annual Semiannual 100 4 2 1 100 For each bond answer the following questions: a. What is the price (present value) today of the bond? b. Does the bond sell at par, below par or above par? c. What is the duration of the bond? d. What is the modified duration? What does it mean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts