Question: Question 2: From this example can you explain precisely the solution and also derive the formula from this example l;: I!a. Evaluation of New Equipment

Question 2: From this example can you explain precisely the solution and also derive the formula from this example

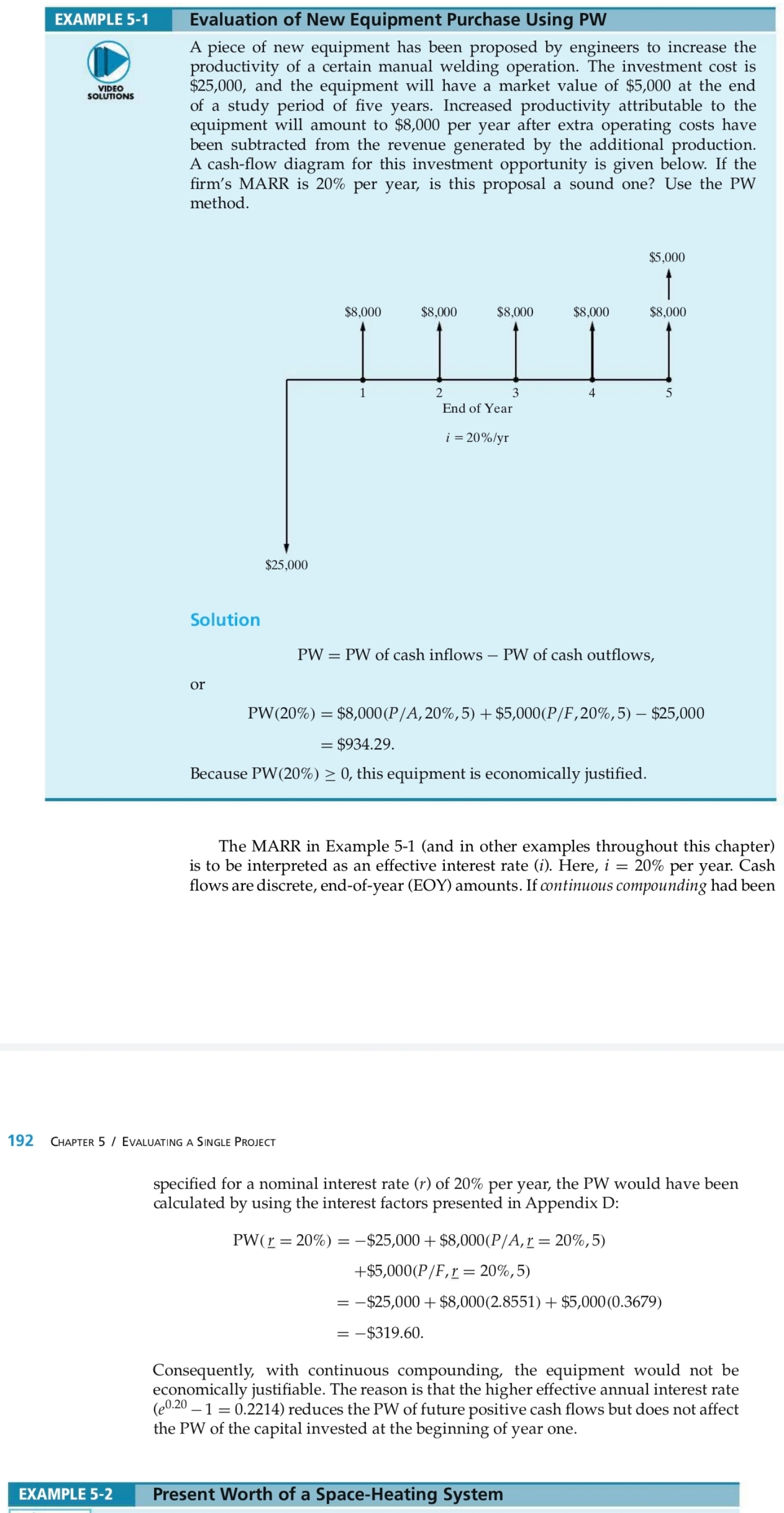

l;: I!a. Evaluation of New Equipment Purchase Using PW A piece of new equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. The investment cost is soVbED $25,000, and the equipment will have a market value of $5,000 at the end of a study period of five years. Increased productivity attributable to the equipment will amount to $8,000 per year after extra operating costs have been subtracted from the revenue generated by the additional production. A cash-flow diagram for this investment opportunity is given below. If the firm's MARR is 20% per year, is this proposal a sound one? Use the PW method. $5,000 $8.000 $8.000 $8.000 $8.000 $8,000 End of Year i =20%/yr $25,000 Solution PW = PW of cash inflows PW of cash outflows, or PW(20%) = $8,000(P/A,20%,5) + $5,000(P/F,20%, 5) $25,000 = $934.29. Because PW(20%) > 0, this equipment is economically justified. The MARR in Example 5-1 (and in other examples throughout this chapter) is to be interpreted as an effective interest rate (/). Here, i = 20% per year. Cash flows are discrete, end-of-year (EOY) amounts. If continuous compounding had been 192 CHAPTER 5 / EVALUATING A SINGLE PROJECT specified for a nominal interest rate (r) of 20% per year, the PW would have been calculated by using the interest factors presented in Appendix D: PW(r =20%) = $25,000 + $8,000(P/A, r = 20%, 5) +$5,000(P/F,r = 20%, 5) = $25,000 + $8,000(2.8551) + $5,000(0.3679) = $319.60. Consequently, with continuous compounding, the equipment would not be economically justifiable. The reason is that the higher effective annual interest rate ("20 1 = 0.2214) reduces the PW of future positive cash flows but does not affect the PW of the capital invested at the beginning of year one. . znm!m Present Worth of a Space-Heating System

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts