Question: Question 1: From this example can you explain precisely the solution ,graph and also derive the formula from this example [mm!m Economic Desirability of a

Question 1: From this example can you explain precisely the solution ,graph and also derive the formula from this example

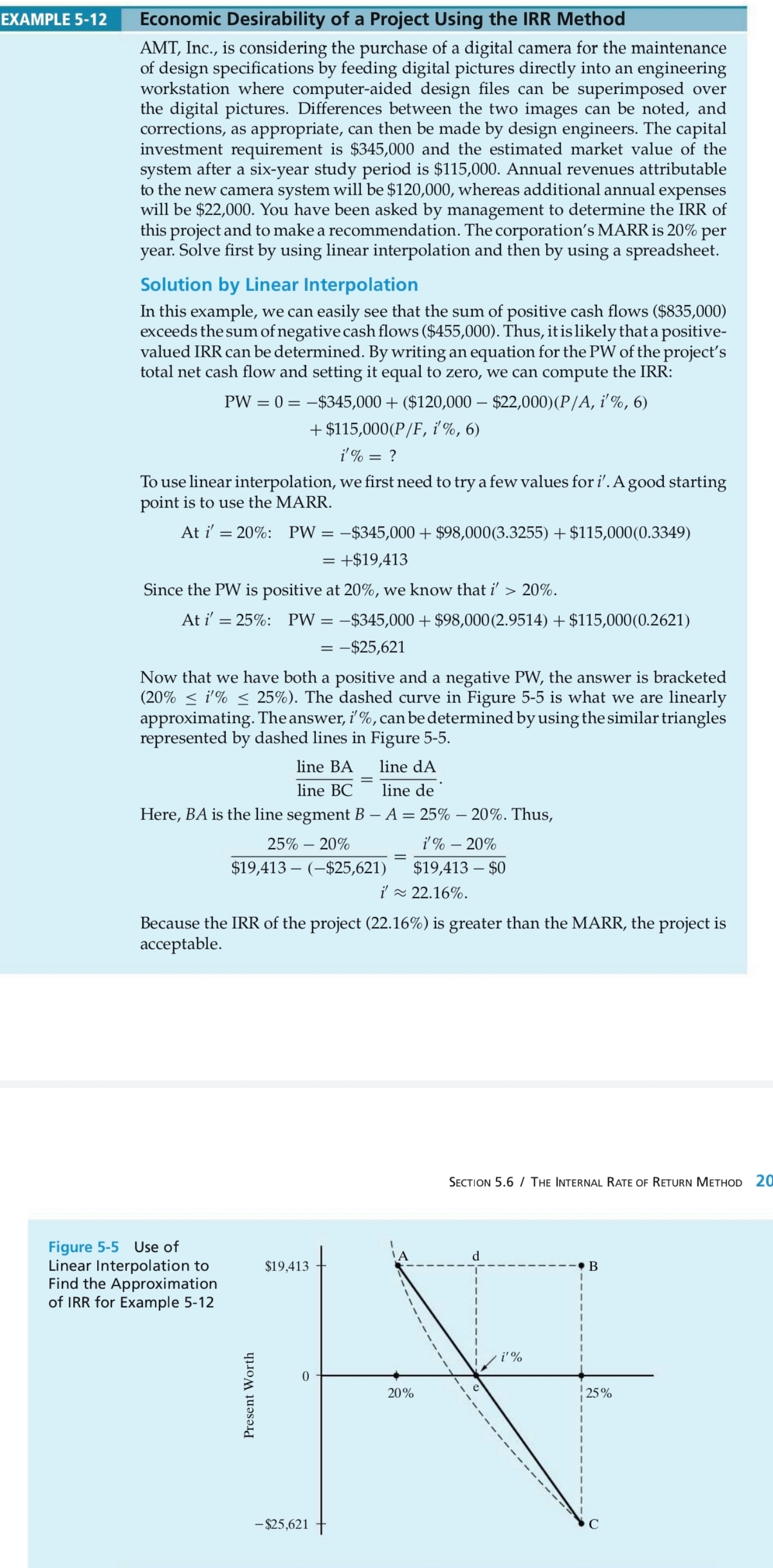

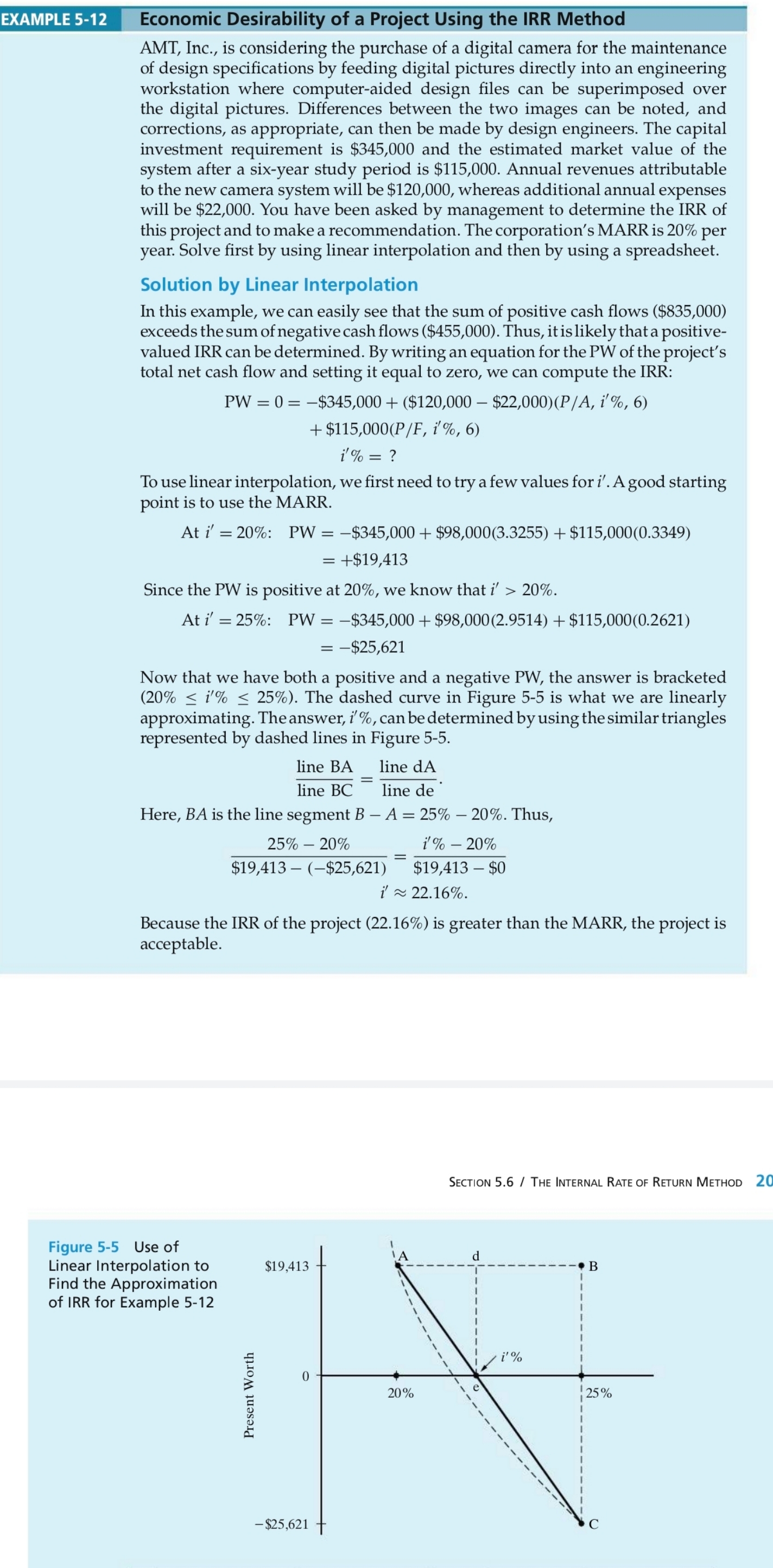

[mm!m Economic Desirability of a Project Using the IRR Method AMT, Inc., is considering the purchase of a digital camera for the maintenance of design specifications by feeding digital pictures directly into an engineering workstation where computer-aided design files can be superimposed over the digital pictures. Differences between the two images can be noted, and corrections, as appropriate, can then be made by design engineers. The capital investment requirement is $345,000 and the estimated market value of the system after a six-year study period is $115,000. Annual revenues attributable to the new camera system will be $120,000, whereas additional annual expenses will be $22,000. You have been asked by management to determine the IRR of this project and to make a recommendation. The corporation's MARR is 20% per year. Solve first by using linear interpolation and then by using a spreadsheet. Solution by Linear Interpolation In this example, we can easily see that the sum of positive cash flows ($835,000) exceeds the sum of negative cash flows ($455,000). Thus, itislikely thata positive- valued IRR can be determined. By writing an equation for the PW of the project's total net cash flow and setting it equal to zero, we can compute the IRR: PW = 0 = $345,000 + ($120,000 $22,000)(P /A, i'%, 6) + $115,000(P /F, i'%, 6) i'% =7 To use linear interpolation, we first need to try a few values for ". A good starting point is to use the MARR. At i =20%: PW = $345,000 + $98,000(3.3255) + $115,000(0.3349) = +$19,413 Since the PW is positive at 20%, we know that i' > 20%. Ati' =25%: PW = $345,000 + $98,000(2.9514) + $115,000(0.2621) = $25,621 Now that we have both a positive and a negative PW, the answer is bracketed (20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts