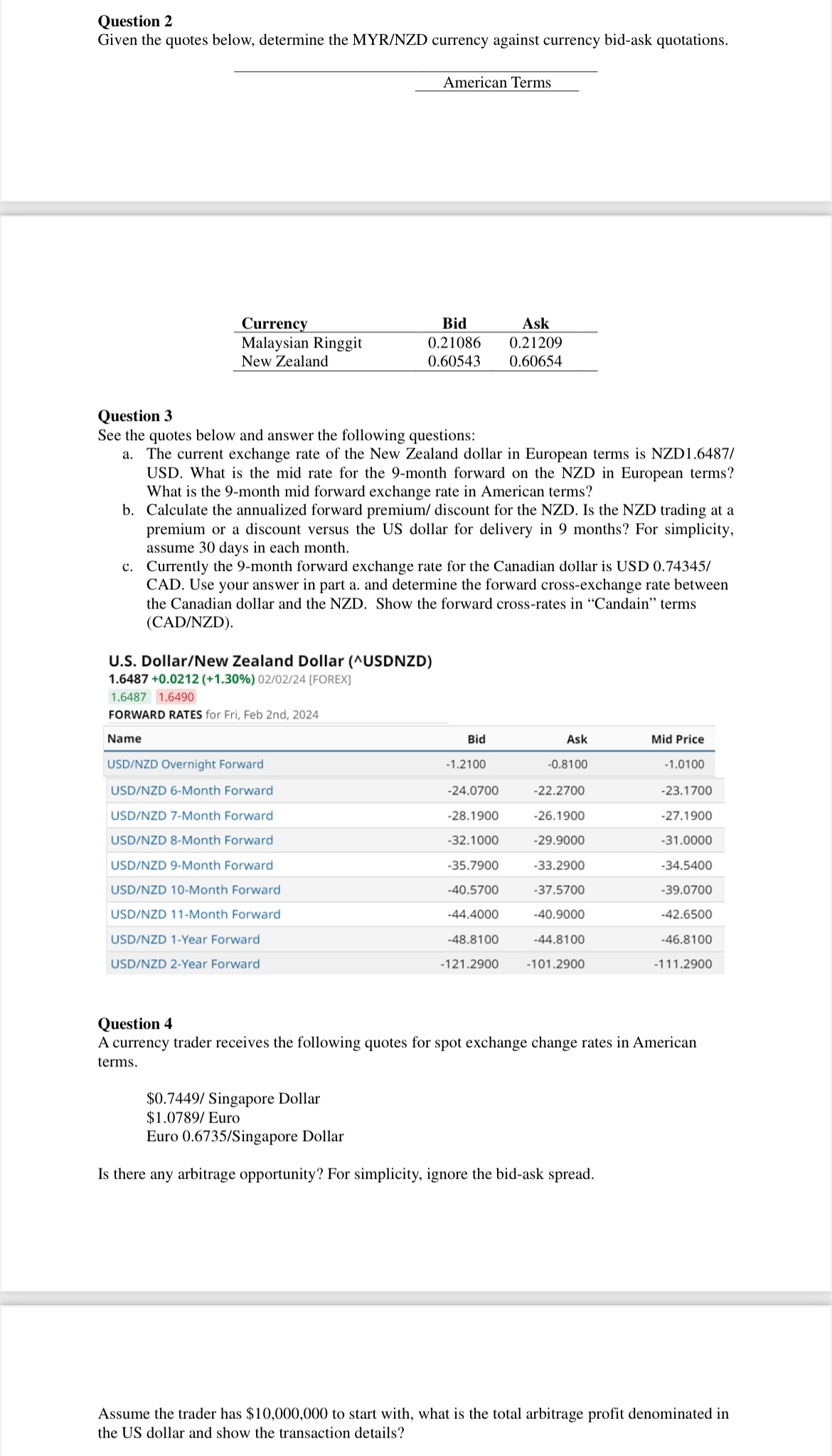

Question: Question 2 Given the quotes below, determine the MYR / NZD currency against currency bid - ask quotations. American Terms table [ [ Currency

Question

Given the quotes below, determine the MYRNZD currency against currency bidask quotations.

American Terms

tableCurrencyBid,AskMalaysian Ringgit,New Zealand,

Question

See the quotes below and answer the following questions:

a The current exchange rate of the New Zealand dollar in European terms is NZD USD. What is the mid rate for the month forward on the NZD in European terms? What is the month mid forward exchange rate in American terms?

b Calculate the annualized forward premium discount for the NZD Is the NZD trading at a premium or a discount versus the US dollar for delivery in months? For simplicity, assume days in each month.

c Currently the month forward exchange rate for the Canadian dollar is USD CAD. Use your answer in part a and determine the forward crossexchange rate between the Canadian dollar and the NZD Show the forward crossrates in "Candain" terms CADNZD

US DollarNew Zealand Dollar USDNZD

FORWARD RATES for Fri, Feb nd

tableNameBid,Ask,Mid PriceUSDNZD Overnight Forward,USDNZD Month Forward,USDNZD Month Forward,USDNZD Month Forward,USDNZD Month Forward,USDNZD Month Forward,USDNZD Month Forward,USDNZD Year Forward,USDNZD Year Forward,

Question

A currency trader receives the following quotes for spot exchange change rates in American terms.

$ Singapore Dollar

$ Euro

Euro Singapore Dollar

Is there any arbitrage opportunity? For simplicity, ignore the bidask spread.

Assume the trader has $ to start with, what is the total arbitrage profit denominated in the US dollar and show the transaction details?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock