Question: Question 2 i) Fin Inc is considering three possible financing arrangements to raise RMI million of new capital. Currently, the capital structure consists of no

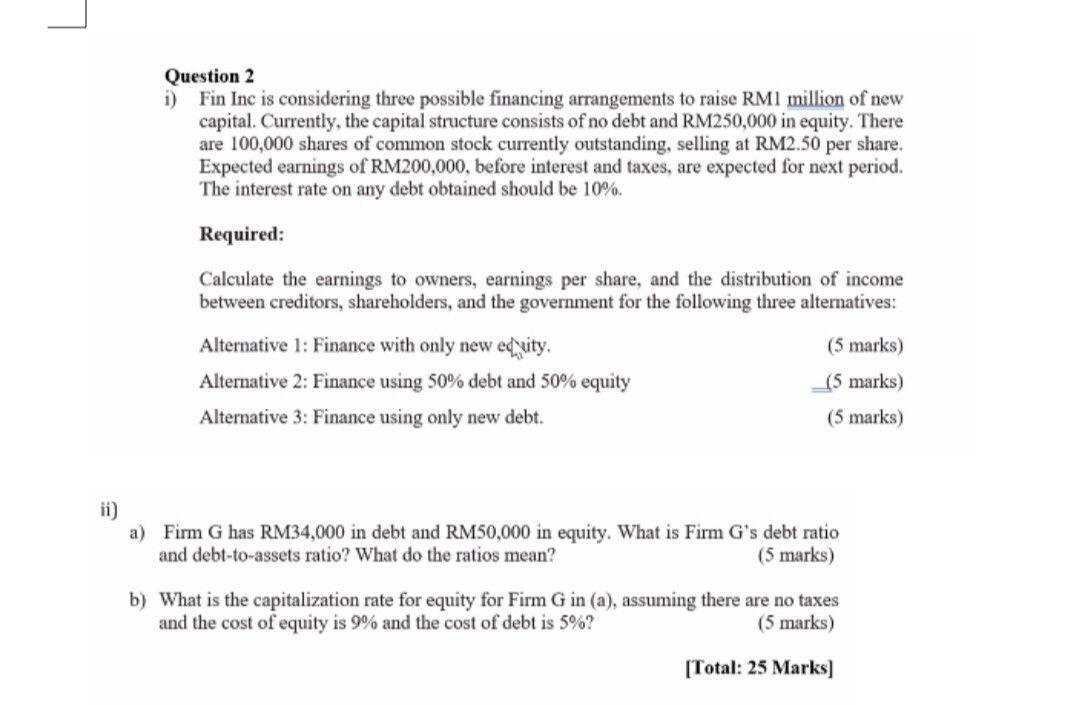

Question 2 i) Fin Inc is considering three possible financing arrangements to raise RMI million of new capital. Currently, the capital structure consists of no debt and RM250,000 in equity. There are 100,000 shares of common stock currently outstanding, selling at RM2.50 per share. Expected earnings of RM200,000, before interest and taxes, are expected for next period. The interest rate on any debt obtained should be 10%. Required: Calculate the earnings to owners, earnings per share, and the distribution of income between creditors, shareholders, and the government for the following three alternatives: Alternative 1: Finance with only new equity. (5 marks) Alternative 2: Finance using 50% debt and 50% equity _(5 marks) Alternative 3: Finance using only new debt. (5 marks) ii) a) Firm G has RM34,000 in debt and RM50,000 in equity. What is Firm G's debt ratio and debt-to-assets ratio? What do the ratios mean? (5 marks) b) What is the capitalization rate for equity for Firm G in (a), assuming there are no taxes and the cost of equity is 9% and the cost of debt is 5%? (5 marks) [Total: 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts