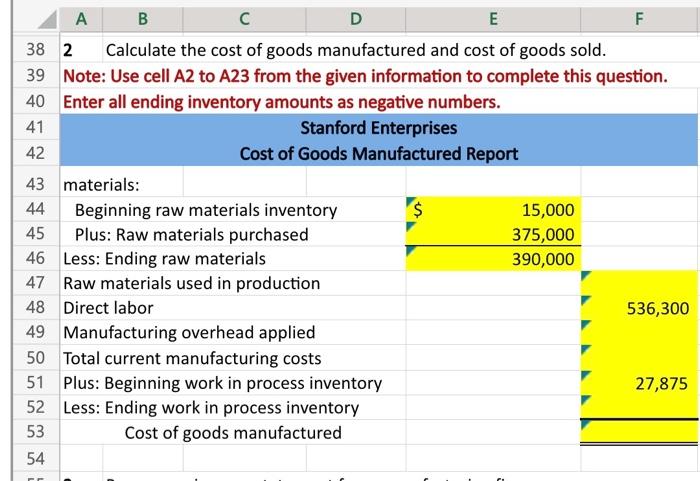

Question: Question 2 in Excel Formula A B C D E F 382 Calculate the cost of goods manufactured and cost of goods sold. 39 Note:

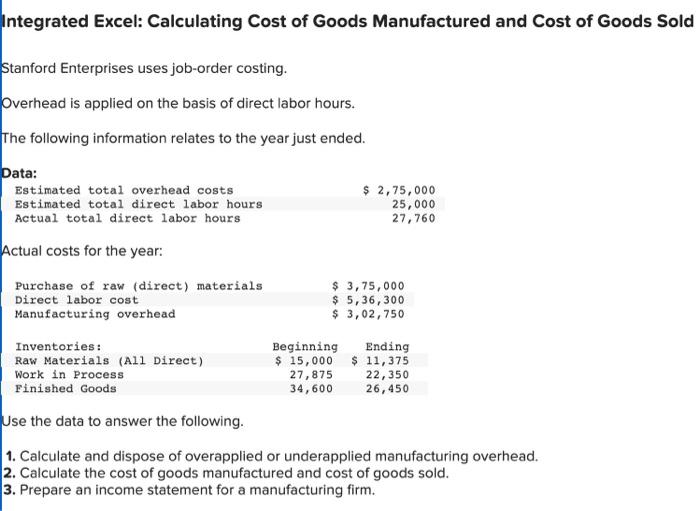

A B C D E F 382 Calculate the cost of goods manufactured and cost of goods sold. 39 Note: Use cell A2 to A23 from the given information to complete this question. Enter all ending inventory amounts as negative numbers. Stanford Enterprises Cost of Goods Manufactured Report materials: \begin{tabular}{lrr} \hline Beginning raw materials inventory & $ & 15,000 \\ \hline Plus: Raw materials purchased & 375,000 \\ \hline Less: Ending raw materials & 390,000 \\ \hline Raw materials used in production & \\ \hline Direct labor & & 536,300 \end{tabular} Manufacturing overhead applied Total current manufacturing costs Plus: Beginning work in process inventory 27,875 Less: Ending work in process inventory Cost of goods manufactured Integrated Excel: Calculating Cost of Goods Manufactured and Cost of Goods Sold Stanford Enterprises uses job-order costing. Overhead is applied on the basis of direct labor hours. The following information relates to the year just ended. Actual costs for the year: Jse the data to answer the following. 1. Calculate and dispose of overapplied or underapplied manufacturing overhead. 2. Calculate the cost of goods manufactured and cost of goods sold. 3. Prepare an income statement for a manufacturing firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts