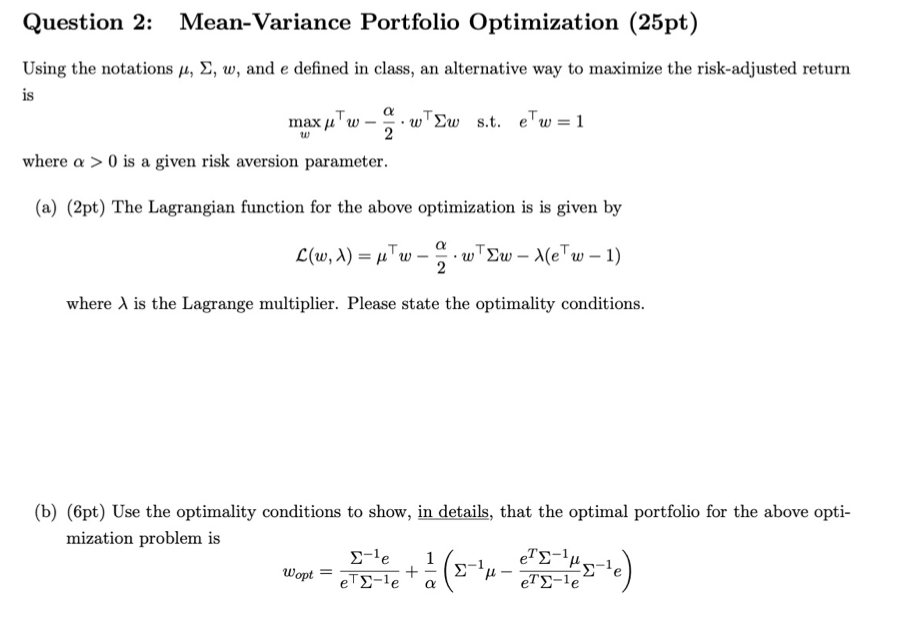

Question: Question 2: Mean-Variance Portfolio Optimization (25pt) Using the notations M, 2, w, and e defined in class, an alternative way to maximize the risk-adjusted return

Question 2: Mean-Variance Portfolio Optimization (25pt) Using the notations M, 2, w, and e defined in class, an alternative way to maximize the risk-adjusted return is max utw wTEws.t. eTw=1 where a > 0 is a given risk aversion parameter. 2 (a) (2pt) The Lagrangian function for the above optimization is is given by a L(w, 1) = ""W wTEw We'w 1) 2 where I is the Lagrange multiplier. Please state the optimality conditions. (b) (6pt) Use the optimality conditions to show, in details, that the optimal portfolio for the above opti- mization problem is -1e 1 ' eT-le + eT-le Question 2: Mean-Variance Portfolio Optimization (25pt) Using the notations M, 2, w, and e defined in class, an alternative way to maximize the risk-adjusted return is max utw wTEws.t. eTw=1 where a > 0 is a given risk aversion parameter. 2 (a) (2pt) The Lagrangian function for the above optimization is is given by a L(w, 1) = ""W wTEw We'w 1) 2 where I is the Lagrange multiplier. Please state the optimality conditions. (b) (6pt) Use the optimality conditions to show, in details, that the optimal portfolio for the above opti- mization problem is -1e 1 ' eT-le + eT-le

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts