Question: Question 2: Multi Step Income Statement (18 marks) Information for 2019 follows for Forest Glen Corporation: Retained earnings, January 1, 2019 $ 1,980,000 Sales revenue

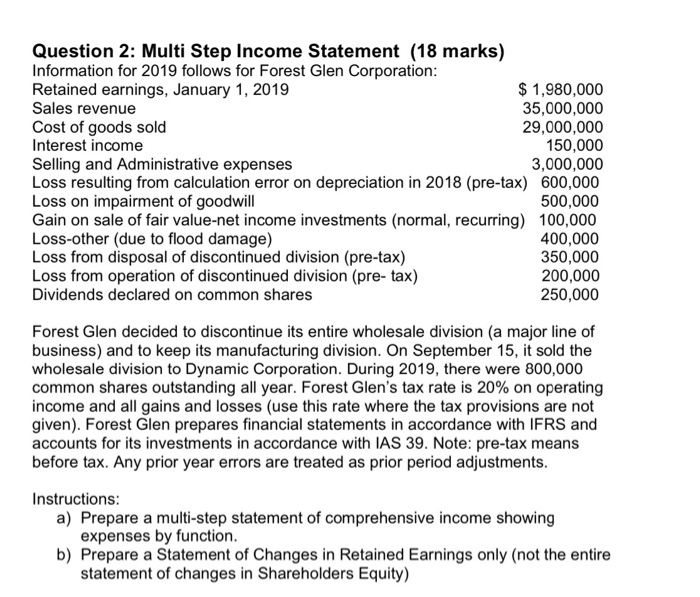

Question 2: Multi Step Income Statement (18 marks) Information for 2019 follows for Forest Glen Corporation: Retained earnings, January 1, 2019 $ 1,980,000 Sales revenue 35,000,000 Cost of goods sold 29,000,000 Interest income 150,000 Selling and Administrative expenses 3,000,000 Loss resulting from calculation error on depreciation in 2018 (pre-tax) 600,000 Loss on impairment of goodwill 500,000 Gain on sale of fair value-net income investments (normal, recurring) 100,000 Loss-other (due to flood damage) 400,000 Loss from disposal of discontinued division (pre-tax) 350,000 Loss from operation of discontinued division (pre- tax) 200,000 Dividends declared on common shares 250,000 Forest Glen decided to discontinue its entire wholesale division (a major line of business) and to keep its manufacturing division. On September 15, it sold the wholesale division to Dynamic Corporation. During 2019, there were 800,000 common shares outstanding all year. Forest Glen's tax rate is 20% on operating income and all gains and losses (use this rate where the tax provisions are not given). Forest Glen prepares financial statements in accordance with IFRS and accounts for its investments in accordance with IAS 39. Note: pre-tax means before tax. Any prior year errors are treated as prior period adjustments. Instructions: a) Prepare a multi-step statement of comprehensive income showing expenses by function. b) Prepare a Statement of Changes in Retained Earnings only (not the entire statement of changes in Shareholders Equity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts