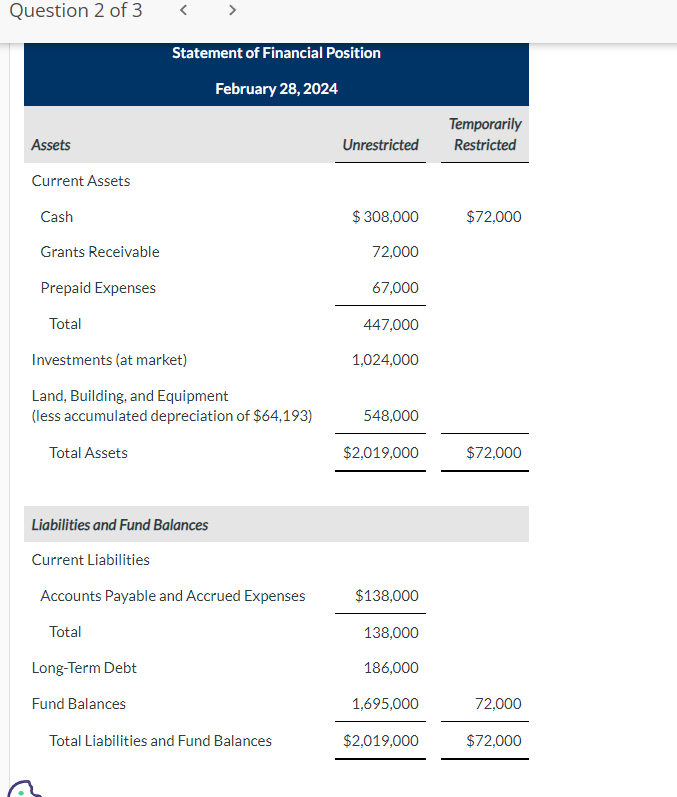

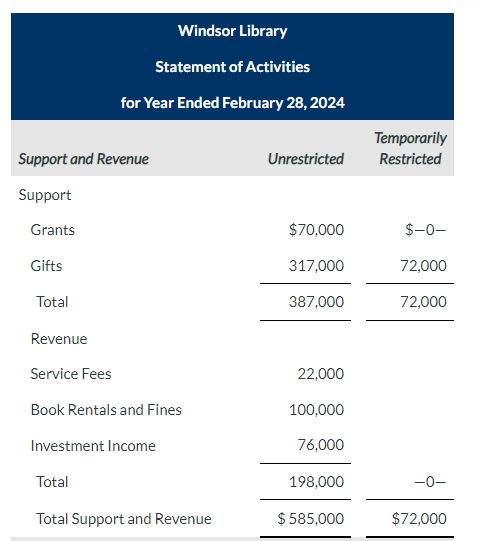

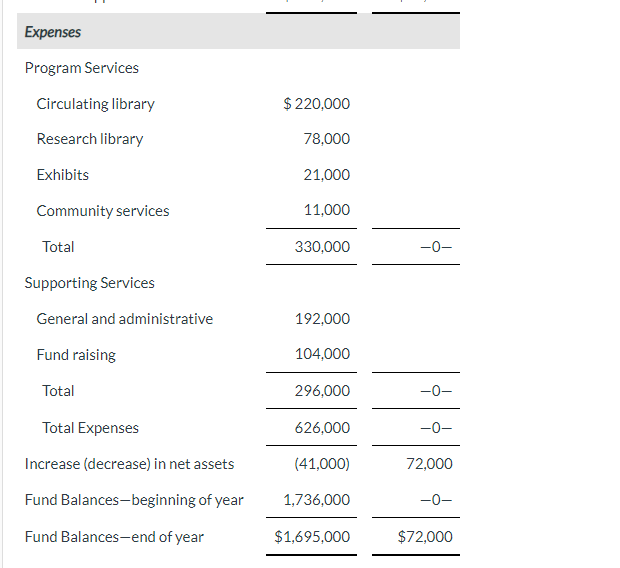

Question: Question 2 of 3 Liabilities and Fund Balances Current Liabilities Windsor Library Statement of Activities for Year Ended February 28, 2024 Expenses Program Services Circulating

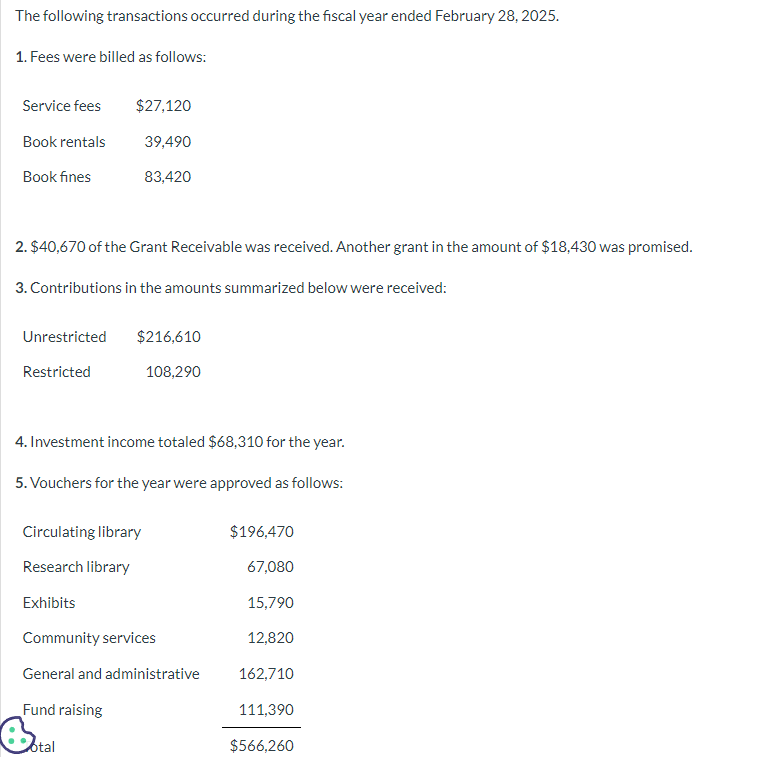

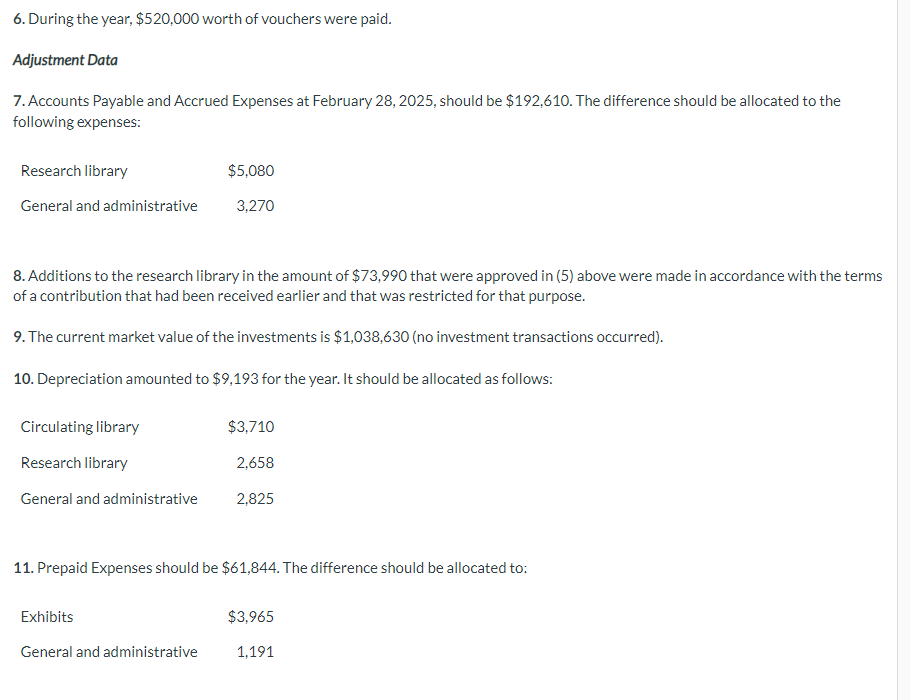

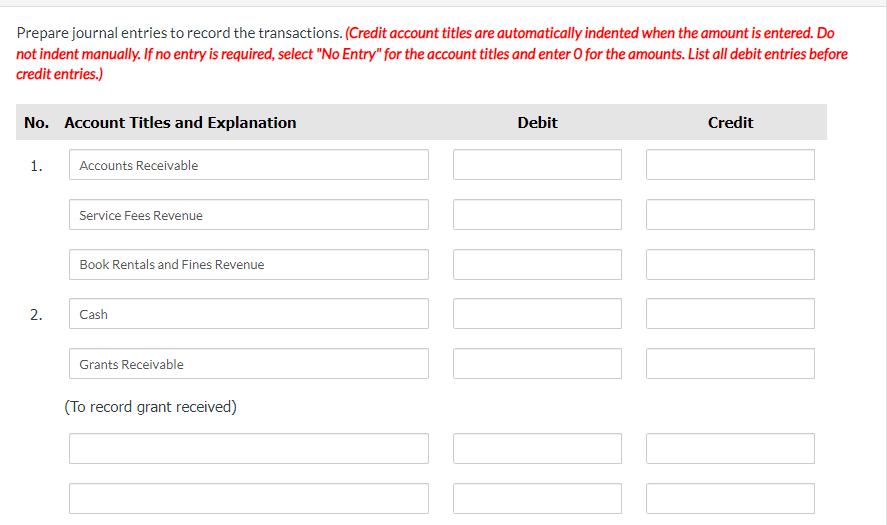

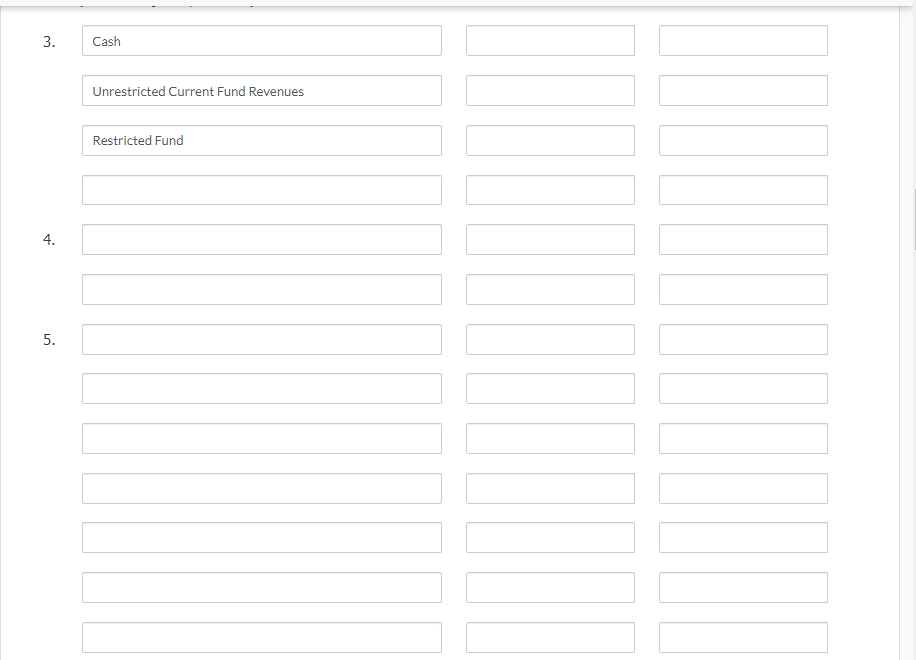

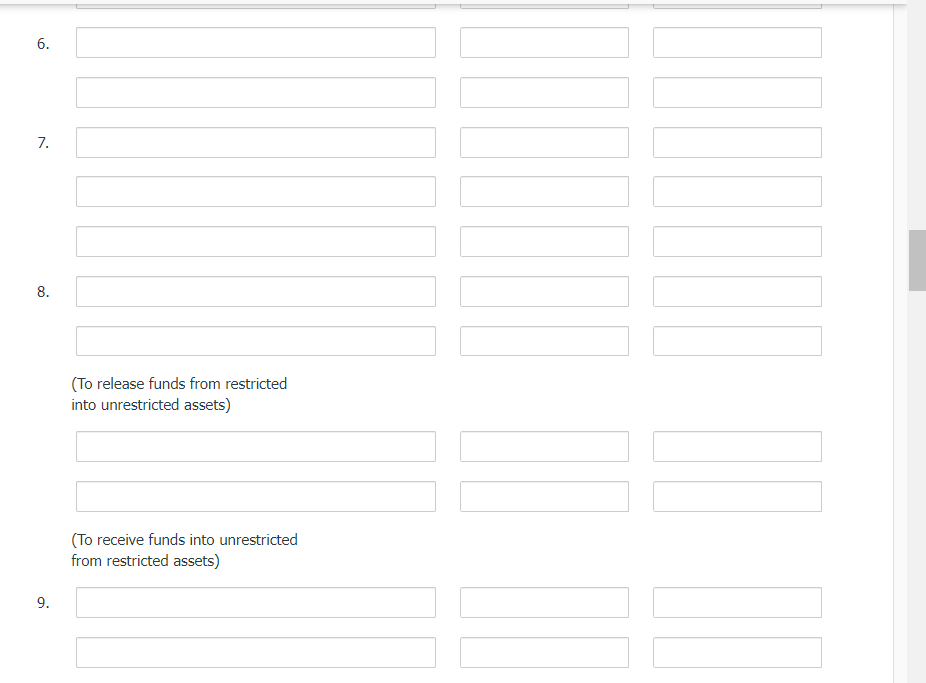

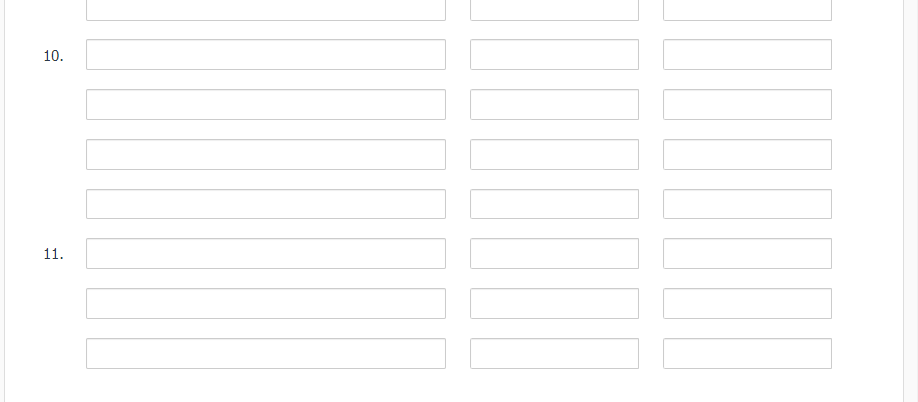

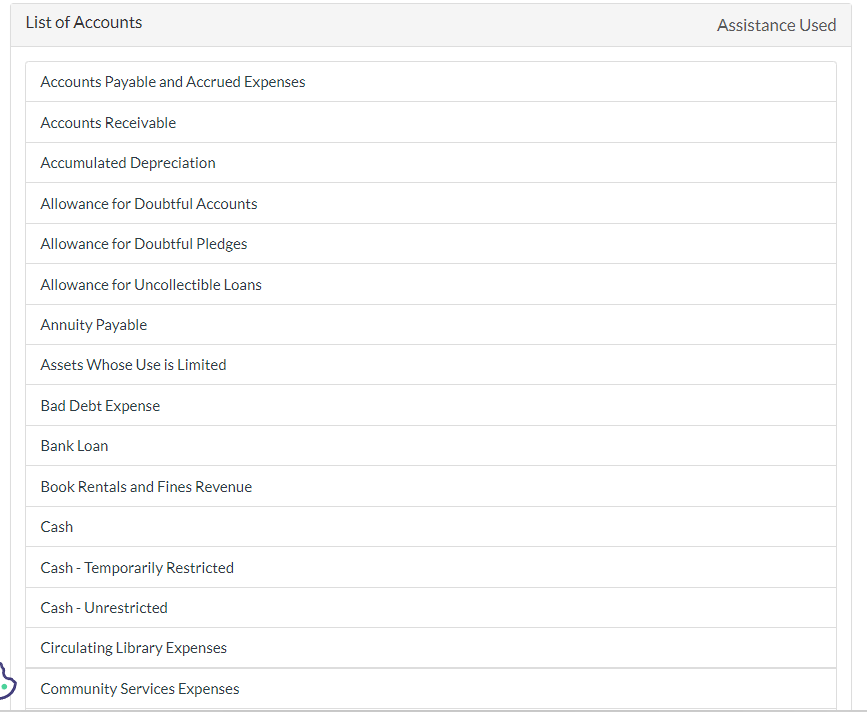

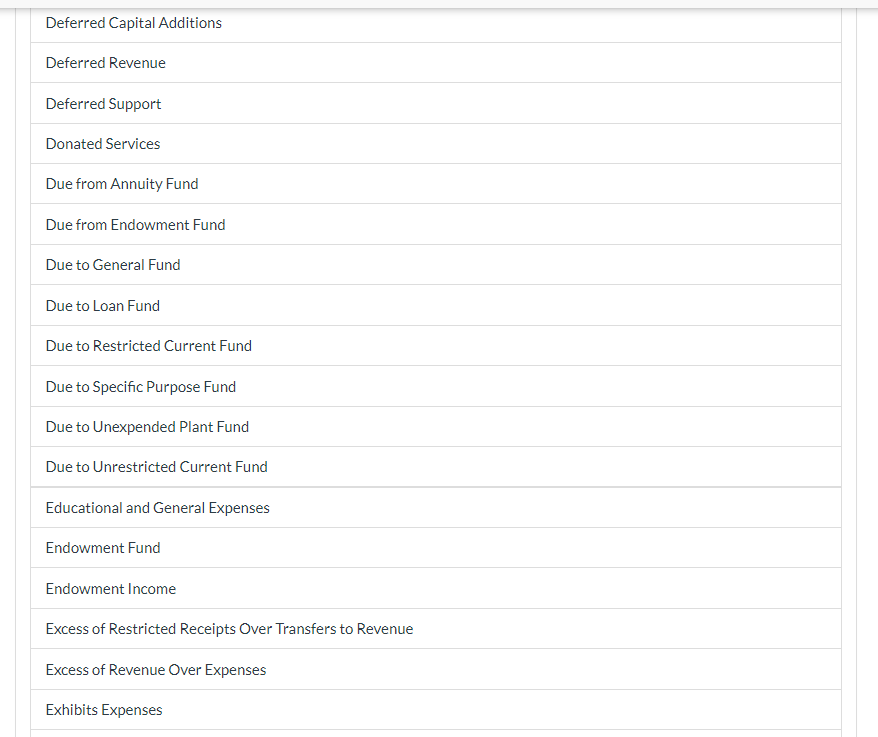

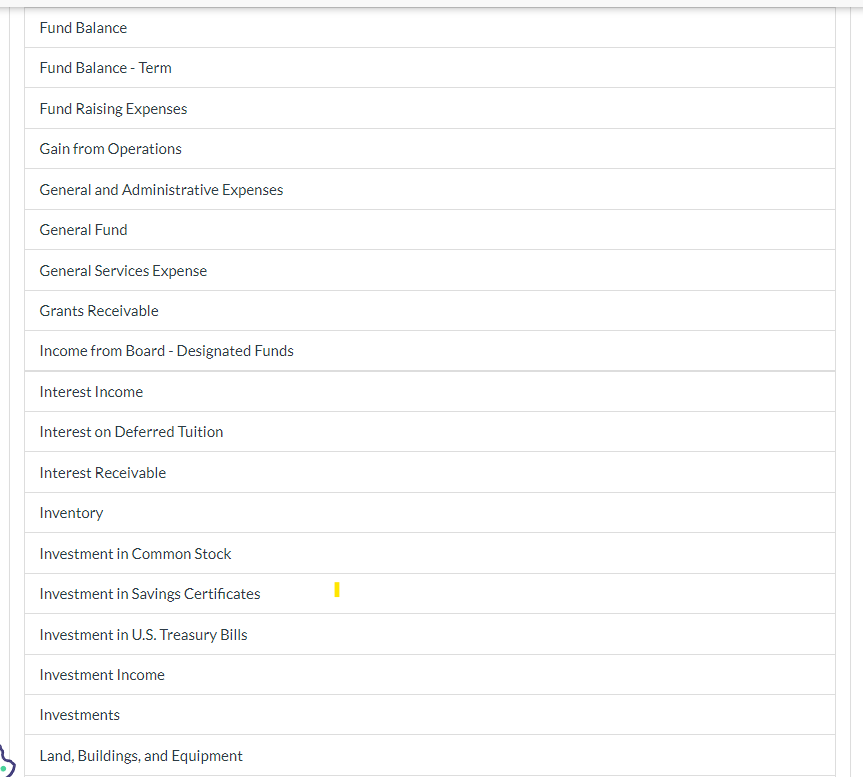

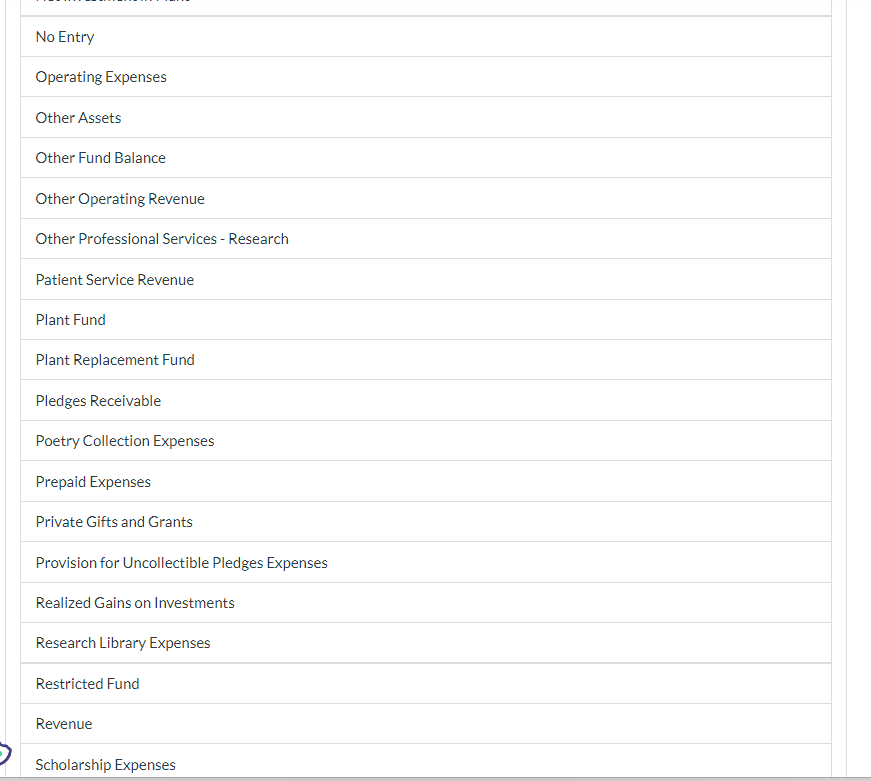

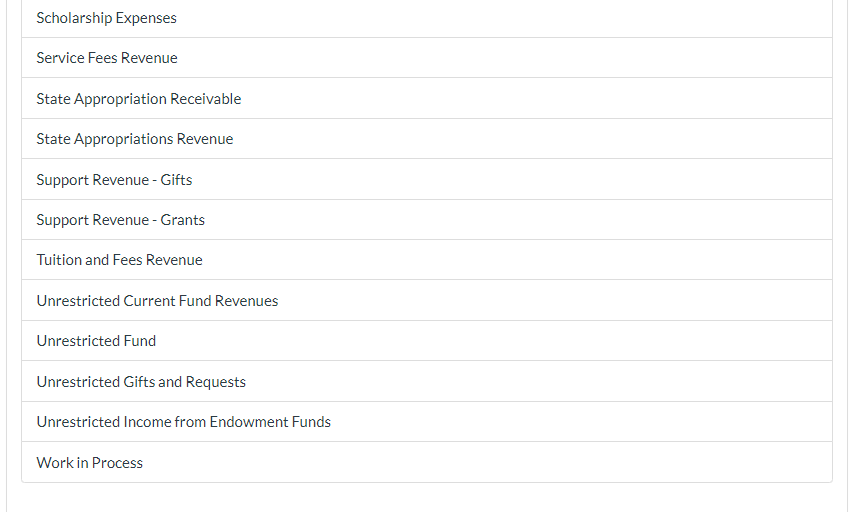

Question 2 of 3 Liabilities and Fund Balances Current Liabilities Windsor Library Statement of Activities for Year Ended February 28, 2024 Expenses Program Services Circulating library Research library Exhibits Community services Total Supporting Services General and administrative Fund raising Total Total Expenses Increase (decrease) in net assets Fund Balances-beginning of year Fund Balances-end of year $220,000 78,000 21,000 330,00011,0000 192,000 104,000 $1,695,0001,736,000$72,0000 The following transactions occurred during the fiscal year ended February 28, 2025 . 1. Fees were billed as follows: 2. $40,670 of the Grant Receivable was received. Another grant in the amount of $18,430 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $68,310 for the year. 5. Vouchers for the year were approved as follows: 6. During the year, $520,000 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2025, should be $192,610. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $73,990 that were approved in (5) above were made in accordance with the term of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,038,630 (no investment transactions occurred). 10. Depreciation amounted to $9,193 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $61,844. The difference should be allocated to: Prepare journal entries to record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) 3. Cash Unrestricted Current Fund Revenues Restricted Fund 4. 5. 6. 7. 8. (To release funds from restricted into unrestricted assets) (To receive funds into unrestricted from restricted assets) 9. 10. 11. List of Accounts Assistance Used Accounts Payable and Accrued Expenses Accounts Receivable Accumulated Depreciation Allowance for Doubtful Accounts Allowance for Doubtful Pledges Allowance for Uncollectible Loans Annuity Payable Assets Whose Use is Limited Bad Debt Expense Bank Loan Book Rentals and Fines Revenue Cash Cash - Temporarily Restricted Cash - Unrestricted Circulating Library Expenses Community Services Expenses Deferred Capital Additions Deferred Revenue Deferred Support Donated Services Due from Annuity Fund Due from Endowment Fund Due to General Fund Due to Loan Fund Due to Restricted Current Fund Due to Specific Purpose Fund Due to Unexpended Plant Fund Due to Unrestricted Current Fund Educational and General Expenses Endowment Fund Endowment Income Excess of Restricted Receipts Over Transfers to Revenue Excess of Revenue Over Expenses Exhibits Expenses Fund Balance Fund Balance - Term Fund Raising Expenses Gain from Operations General and Administrative Expenses General Fund General Services Expense Grants Receivable Income from Board - Designated Funds Interest Income Interest on Deferred Tuition Interest Receivable Inventory Investment in Common Stock Investment in Savings Certificates Investment in U.S. Treasury Bills Investment Income Investments Land, Buildings, and Equipment No Entry Operating Expenses Other Assets Other Fund Balance Other Operating Revenue Other Professional Services - Research Patient Service Revenue Plant Fund Plant Replacement Fund Pledges Receivable Poetry Collection Expenses Prepaid Expenses Private Gifts and Grants Provision for Uncollectible Pledges Expenses Realized Gains on Investments Research Library Expenses Restricted Fund Revenue Scholarship Expenses Scholarship Expenses Service Fees Revenue State Appropriation Receivable State Appropriations Revenue Support Revenue - Gifts Support Revenue - Grants Tuition and Fees Revenue Unrestricted Current Fund Revenues Unrestricted Fund Unrestricted Gifts and Requests Unrestricted Income from Endowment Funds Work in Process Question 2 of 3 Liabilities and Fund Balances Current Liabilities Windsor Library Statement of Activities for Year Ended February 28, 2024 Expenses Program Services Circulating library Research library Exhibits Community services Total Supporting Services General and administrative Fund raising Total Total Expenses Increase (decrease) in net assets Fund Balances-beginning of year Fund Balances-end of year $220,000 78,000 21,000 330,00011,0000 192,000 104,000 $1,695,0001,736,000$72,0000 The following transactions occurred during the fiscal year ended February 28, 2025 . 1. Fees were billed as follows: 2. $40,670 of the Grant Receivable was received. Another grant in the amount of $18,430 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $68,310 for the year. 5. Vouchers for the year were approved as follows: 6. During the year, $520,000 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2025, should be $192,610. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $73,990 that were approved in (5) above were made in accordance with the term of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,038,630 (no investment transactions occurred). 10. Depreciation amounted to $9,193 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $61,844. The difference should be allocated to: Prepare journal entries to record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) 3. Cash Unrestricted Current Fund Revenues Restricted Fund 4. 5. 6. 7. 8. (To release funds from restricted into unrestricted assets) (To receive funds into unrestricted from restricted assets) 9. 10. 11. List of Accounts Assistance Used Accounts Payable and Accrued Expenses Accounts Receivable Accumulated Depreciation Allowance for Doubtful Accounts Allowance for Doubtful Pledges Allowance for Uncollectible Loans Annuity Payable Assets Whose Use is Limited Bad Debt Expense Bank Loan Book Rentals and Fines Revenue Cash Cash - Temporarily Restricted Cash - Unrestricted Circulating Library Expenses Community Services Expenses Deferred Capital Additions Deferred Revenue Deferred Support Donated Services Due from Annuity Fund Due from Endowment Fund Due to General Fund Due to Loan Fund Due to Restricted Current Fund Due to Specific Purpose Fund Due to Unexpended Plant Fund Due to Unrestricted Current Fund Educational and General Expenses Endowment Fund Endowment Income Excess of Restricted Receipts Over Transfers to Revenue Excess of Revenue Over Expenses Exhibits Expenses Fund Balance Fund Balance - Term Fund Raising Expenses Gain from Operations General and Administrative Expenses General Fund General Services Expense Grants Receivable Income from Board - Designated Funds Interest Income Interest on Deferred Tuition Interest Receivable Inventory Investment in Common Stock Investment in Savings Certificates Investment in U.S. Treasury Bills Investment Income Investments Land, Buildings, and Equipment No Entry Operating Expenses Other Assets Other Fund Balance Other Operating Revenue Other Professional Services - Research Patient Service Revenue Plant Fund Plant Replacement Fund Pledges Receivable Poetry Collection Expenses Prepaid Expenses Private Gifts and Grants Provision for Uncollectible Pledges Expenses Realized Gains on Investments Research Library Expenses Restricted Fund Revenue Scholarship Expenses Scholarship Expenses Service Fees Revenue State Appropriation Receivable State Appropriations Revenue Support Revenue - Gifts Support Revenue - Grants Tuition and Fees Revenue Unrestricted Current Fund Revenues Unrestricted Fund Unrestricted Gifts and Requests Unrestricted Income from Endowment Funds Work in Process

Step by Step Solution

There are 3 Steps involved in it

To record the transactions for Windsor Library for the fiscal year ended February 28 2025 we will create the journal entries 1 Fees were billed as follows Service fees 27120 Book rentals 39490 Book fi... View full answer

Get step-by-step solutions from verified subject matter experts