Question: Question 2 of 4 Read the case study below and choose the best possible answer to the following question. During Jennifer's first year of college,

Question of

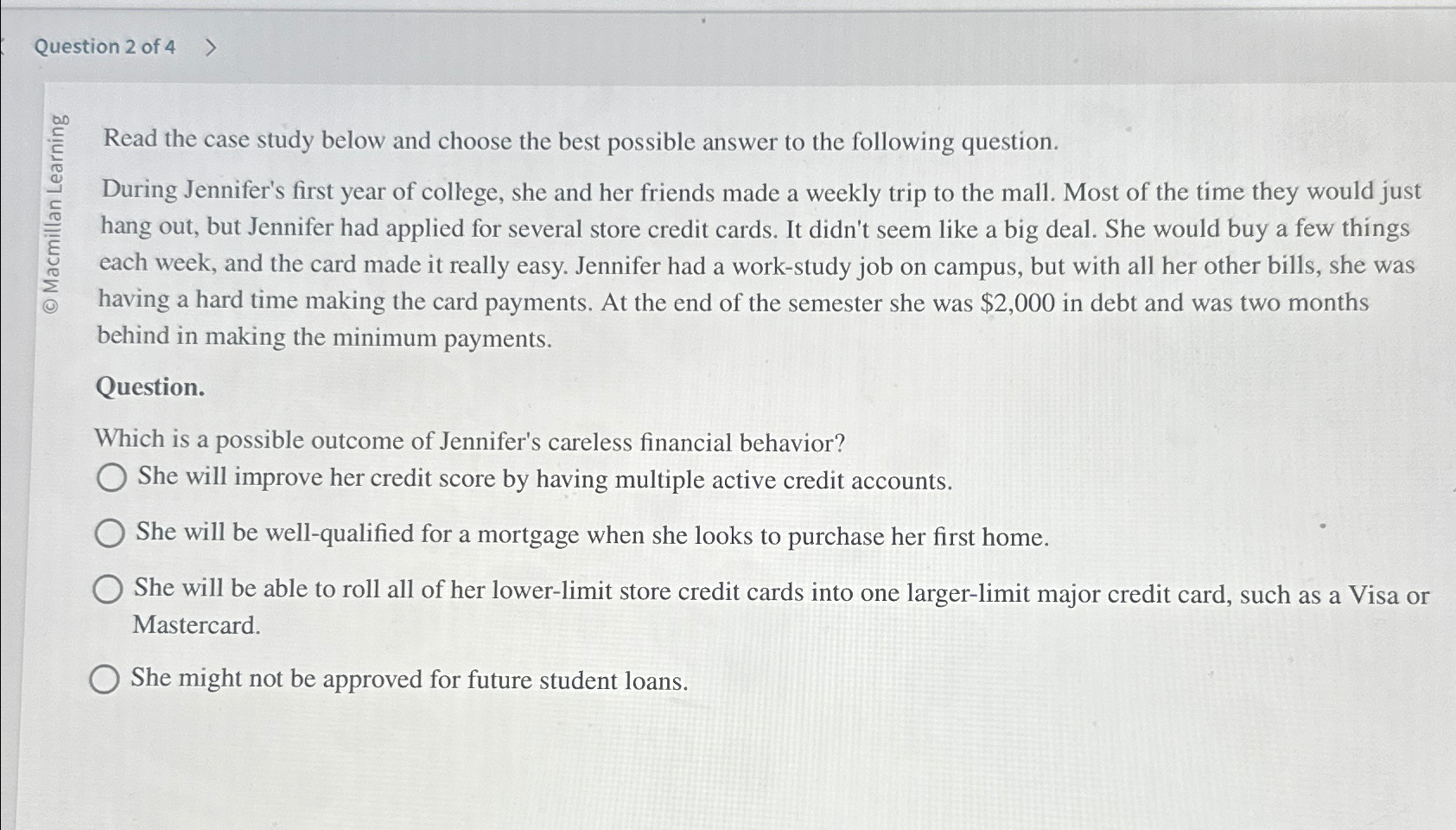

Read the case study below and choose the best possible answer to the following question.

During Jennifer's first year of college, she and her friends made a weekly trip to the mall. Most of the time they would just hang out, but Jennifer had applied for several store credit cards. It didn't seem like a big deal. She would buy a few things each week, and the card made it really easy. Jennifer had a workstudy job on campus, but with all her other bills, she was having a hard time making the card payments. At the end of the semester she was $ in debt and was two months behind in making the minimum payments.

Question.

Which is a possible outcome of Jennifer's careless financial behavior?

She will improve her credit score by having multiple active credit accounts.

She will be wellqualified for a mortgage when she looks to purchase her first home.

She will be able to roll all of her lowerlimit store credit cards into one largerlimit major credit card, such as a Visa or Mastercard.

She might not be approved for future student loans.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock