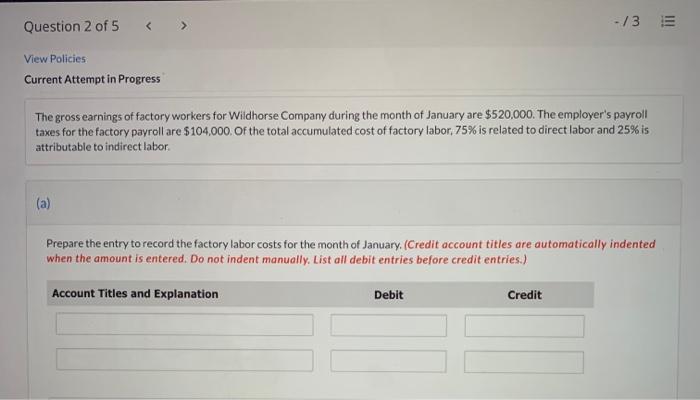

Question: Question 2 of 5 -/3 E View Policies Current Attempt in Progress The gross earnings of factory workers for Wildhorse Company during the month of

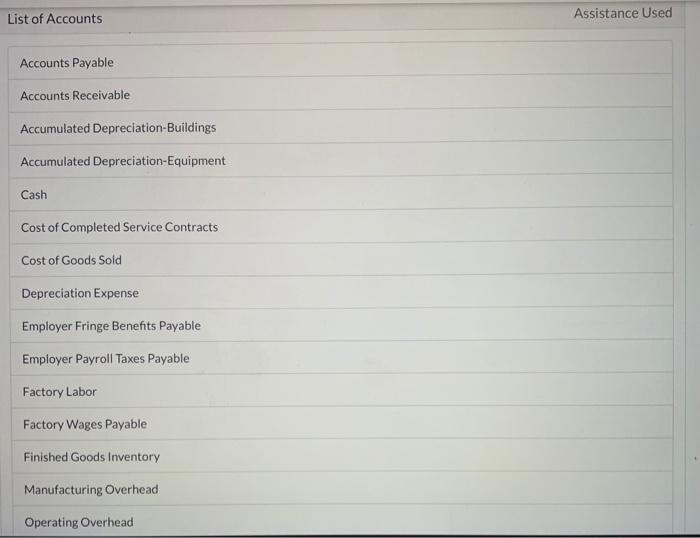

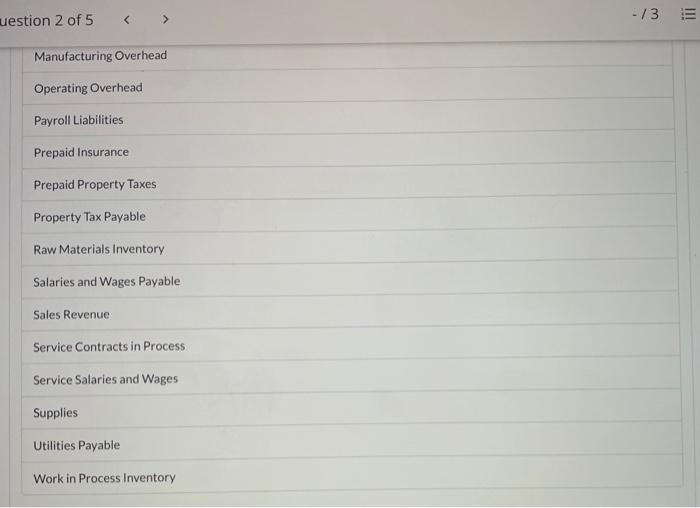

Question 2 of 5 -/3 E View Policies Current Attempt in Progress The gross earnings of factory workers for Wildhorse Company during the month of January are $520,000. The employer's payroll taxes for the factory payroll are $104,000. Of the total accumulated cost of factory labor, 75% is related to direct labor and 25% is attributable to indirect labor. (a) Prepare the entry to record the factory labor costs for the month of January. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit List of Accounts Assistance Used Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Cash Cost of Completed Service Contracts Cost of Goods Sold Depreciation Expense Employer Fringe Benefits Payable Employer Payroll Taxes Payable Factory Labor Factory Wages Payable Finished Goods Inventory Manufacturing Overhead Operating Overhead -13 III uestion 2 of 5 Manufacturing Overhead Operating Overhead Payroll Liabilities Prepaid Insurance Prepaid Property Taxes Property Tax Payable Raw Materials Inventory Salaries and Wages Payable Sales Revenue Service Contracts in Process Service Salaries and Wages Supplies Utilities Payable Work in Process Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts