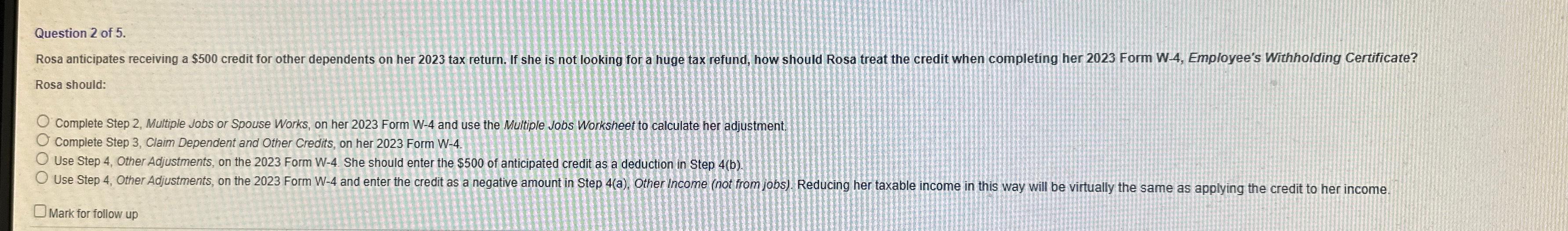

Question: Question 2 of 5. Rosa should: Complete Step 2, Multiple Jobs or Spouse Works, on her 2023 Form W-4 and use the Multiple Jobs Worksheet

Question 2 of 5.\ Rosa should:\ Complete Step 2, Multiple Jobs or Spouse Works, on her 2023 Form W-4 and use the Multiple Jobs Worksheet to calculate her adjustment.\ Complete Step 3, Claim Dependent and Other Credits, on her 2023 Form W-4\ Use Step 4, Other Adjustments, on the 2023 Form W-4. She should enter the

$500of anticipated credit as a deduction in Step 4 (b).\ Mark for follow up

Question 2 of 5. Rosa should: Complete Step 2, Multiple Jobs or Spouse Works, on her 2023 Form W-4 and use the Multiple Jobs Worksheet to calculate her adjustment. Complete Step 3, Claim Dependent and Other Credits, on her 2023 Form W-4. Use Step 4, Other Adjustments, on the 2023 Form W-4. She should enter the $500 of anticipated credit as a deduction in Step 4 (b). Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts