Question: Old Jeans Berhad (OJB) is considering a project which requires an investment of RM100, 000 in machinery. This machinery will be depreciated using straight-line

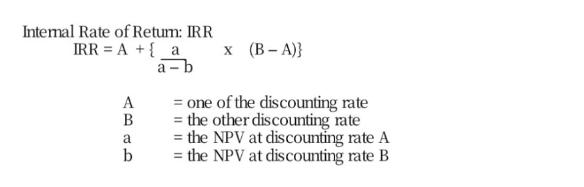

Old Jeans Berhad (OJB) is considering a project which requires an investment of RM100, 000 in machinery. This machinery will be depreciated using straight-line over four years period and the salvage value is estimated to be zero by the end of this machine useful life. The project sales forecast for the next four years is as follows: Year 1 2 3 4 Sales (units) 900 800 700 600 The selling price per unit is RMI 5 and the variable cost per unit is RM10. The project requires an increase in net working capital of RM40,000 in the initial year and will be fully recovered at the end of the project. The firm's required return on investment of 12%. OJB thinks that the unit sales, selling price and variable cost projections are accurate to within 10%. Formula Net Present Value Note: The calculation on depreciation, fixed cost and the effect on tax is ignored for this question. From the given information, you are required to answer the following questions. a. Determine the upper and lower bounds for this projection. (4 Marks) b. Based on your answer in part (a), prepare the Cash Flows Analysis clearly showing the Net Present Value (NPV) for the best and worst-case scenario. (4 Marks) c. Based on the NPV in part (b), interpret your findings. (2 Marks) (Total: 10 Marks) NPV = Annual Cash Flow Initial Investment (1+k)t Internal Rate of Return: IRR IRR = A + { a a-b A B = one of the discounting rate = the other discounting rate = the NPV at discounting rate A b = the NPV at discounting rate B 4846 x (B-A)} a

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

a Determine the upper and lower bounds for this projection Original Data Selling Price per UnitRM15 Variable Cost per UnitRM10 Adjusted Data Upper Bou... View full answer

Get step-by-step solutions from verified subject matter experts