Question: Question 2 On 1 January 2 0 2 1 . Alpha Ltd , a company that deals in heavy machinery, entered into a finance lease

Question

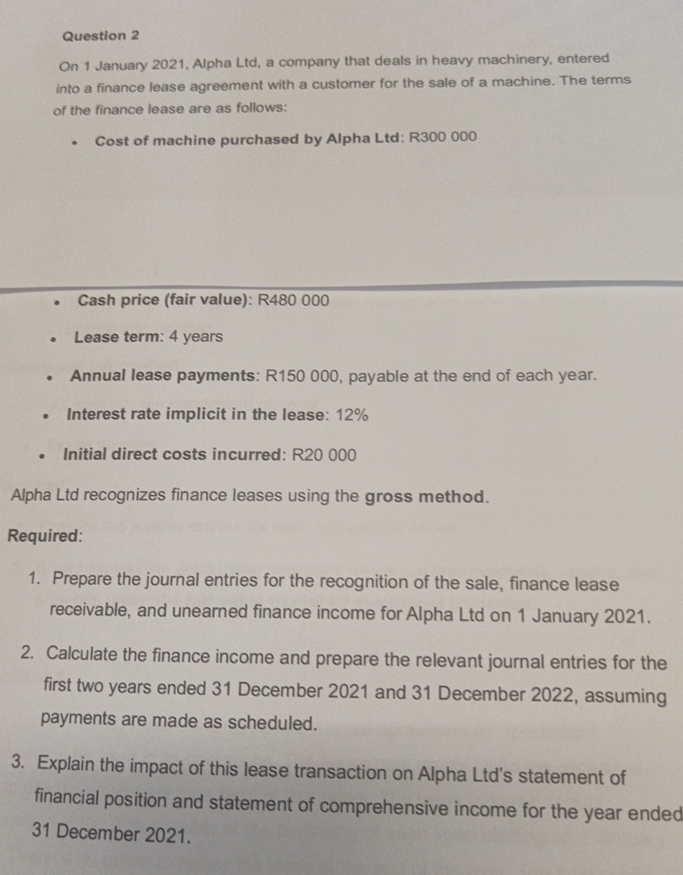

On January Alpha Ltd a company that deals in heavy machinery, entered into a finance lease agreement with a customer for the sale of a machine. The terms of the finance lease are as follows:

Cost of machine purchased by Alpha Ltd: R

Cash price fair value: R

Lease term: years

Annual lease payments: R payable at the end of each year.

Interest rate implicit in the lease:

Initial direct costs incurred: R

Alpha Ltd recognizes finance leases using the gross method.

Required:

Prepare the journal entries for the recognition of the sale, finance lease receivable, and unearned finance income for Alpha Ltd on January

Calculate the finance income and prepare the relevant journal entries for the first two years ended December and December assuming payments are made as scheduled.

Explain the impact of this lease transaction on Alpha Ltds statement of financial position and statement of comprehensive income for the year ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock