Question: Question 2 Only need the ones thst are incorrect, please do not recyoe the answers from here since there are wrong Partially correct Mark 6

Question Only need the ones thst are incorrect, please do not recyoe the answers from here since there are wrong

Partially correct

Mark out of

Flag question

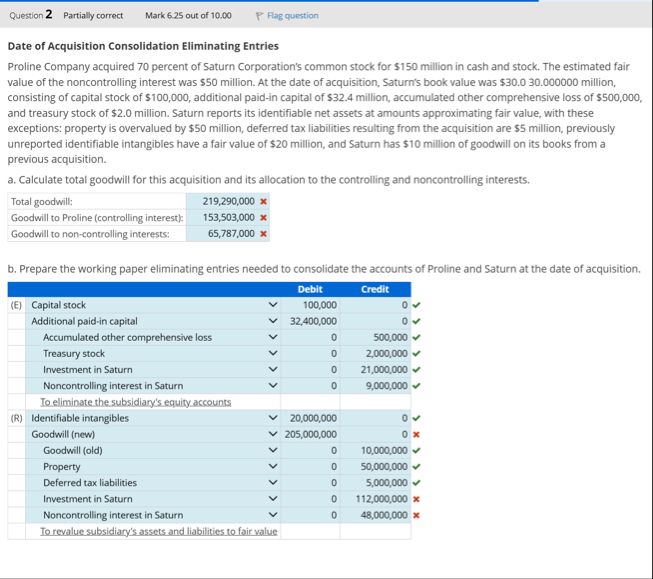

Date of Acquisition Consolidation Eliminating Entries

Proline Company acquired percent of Saturn Corporation's common stock for $ million in cash and stock. The estimated fair value of the noncontrolling interest was $ million. At the date of acquisition, Saturn's book value was $ million, consisting of capital stock of $ additional paidin capital of $ million, accumulated other comprehensive loss of $ and treasury stock of $ million. Saturn reports its identifiable net assets at amounts approximating fair value, with these exceptions: property is overvalued by $ million, deferred tax liabilities resulting from the acquisition are $ million, previously unreported identifiable intangibles have a fair value of $ million, and Saturn has $ million of goodwill on its books from a previous acquisition.

a Calculate total goodwill for this acquisition and its allocation to the controlling and noncontrolling interests.

tableTotal goodwill:,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock