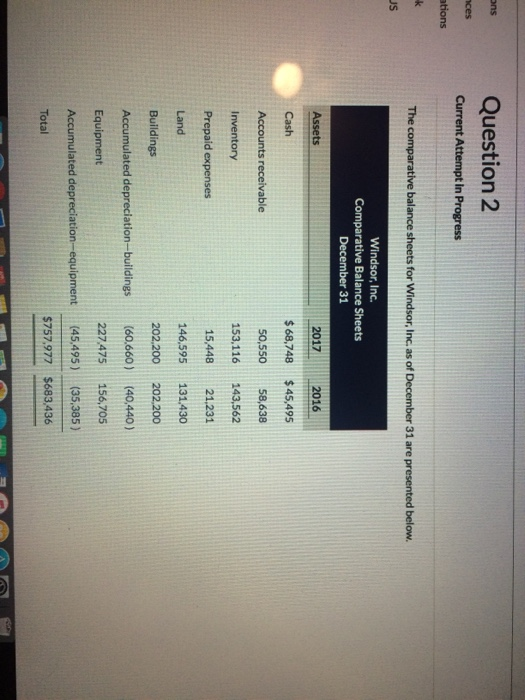

Question: Question 2 ons ces Current Attempt in Progress tions The comparative balance sheets for Windsor, Inc, as of December 31 are presented below uS Windsor,

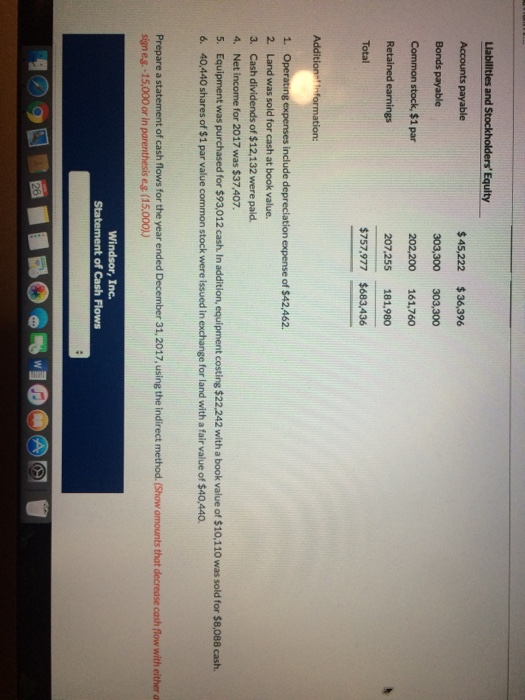

Question 2 ons ces Current Attempt in Progress tions The comparative balance sheets for Windsor, Inc, as of December 31 are presented below uS Windsor, Inc. Comparative Balance Sheets December 31 2017 2016 $68,748$45,495 50,55058,638 153,116143,562 5,44821,231 146,595131.430 202.200 202.200 Cash Accounts receivable Inventory Prepaid expenses Land Buildings Accumulated depreciation-buildings(60.660) (40,440) Equipment Accumulated depreciation-equipment (45,495) (35.385) Total 227475 156.705 $757.977 $683,436 Accounts payable $45,222 $36,396 303,300 303,300 202,200 161,760 207,255 181,980 $757.977 $683.436 Bonds payable Total expenses include depreciation expense of $42,462. 2. Land was sold for cash at book value. 3. Cash dividends of $12,132 were paid. 4. Net income for 2017 was $37.407. 5. Equipment was purchased for $93,012 cash. In addition, equipment costing $22.242 with a book value of $10,110 was sold for $8,088 cash 6. 40,440 shares of $1 par value common stock were issued in exchange for land with a fair value of $40,440. Prepare a statement of cash flows for the year ended December 31, 2017, using the indirect method. (Show omounts that decrease cash flow with either a signeg.-15,000 or in parenthesis e-s (15,000),) Wi , Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts