Question: Question #2 Please. Please don't copy others' work because I couldn't understand the solution that's around online. Also, I would appreciate it if you could

Question #2 Please.

Please don't copy others' work because I couldn't understand the solution that's around online.

Also, I would appreciate it if you could write in a neat manner.

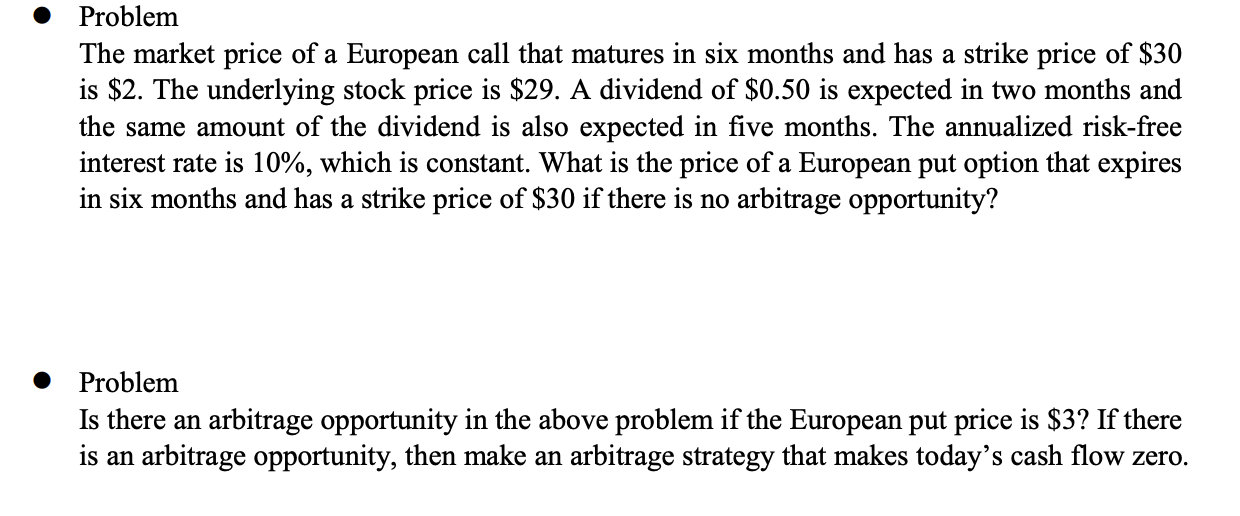

Problem The market price of a European call that matures in six months and has a strike price of $30 is $2. The underlying stock price is $29. A dividend of $0.50 is expected in two months and the same amount of the dividend is also expected in five months. The annualized risk-free interest rate is 10%, which is constant. What is the price of a European put option that expires in six months and has a strike price of $30 if there is no arbitrage opportunity? Problem Is there an arbitrage opportunity in the above problem if the European put price is $3? If there is an arbitrage opportunity, then make an arbitrage strategy that makes today's cash flow zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts