Question: Question 2: Prime Printing plc 2.Prime Printing ple has the opportunity to replace one of its pieces of printing equipment. The new machine, costing 120,000,

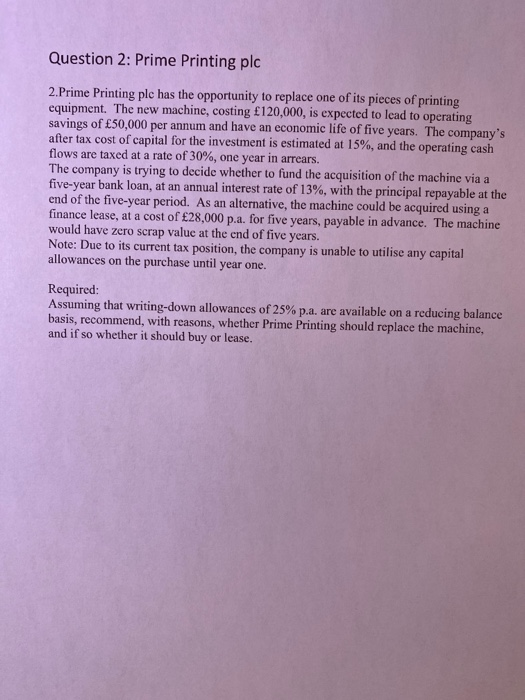

Question 2: Prime Printing plc 2.Prime Printing ple has the opportunity to replace one of its pieces of printing equipment. The new machine, costing 120,000, is expected to lead to operating savings of 50,000 per annum and have an economic life of five years. The company's after tax cost of capital for the investment is estimated at 15%, and the operating cash flows are taxed at a rate of 30%, one year in arrears. The company is trying to decide whether to fund the acquisition of the machine via a five-year bank loan, at an annual interest rate of 13%, with the principal repayable at the end of the five-year period. As an alternative, the machine could be acquired using a finance lease, at a cost of 28,000 p.a. for five years, payable in advance. The machine would have zero scrap value at the end of five years. Note: Due to its current tax position, the company is unable to utilise any capital allowances on the purchase until year one. Required: Assuming that writing-down allowances of 25% p.a. are available on a reducing balance basis, recommend, with reasons, whether Prime Printing should replace the machine, and if so whether it should buy or lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts