Question: Question 2: Property Finance Case Study (Total 20 marks) A. You are purchasing an investment property for $350,000. The property is expected to generate a

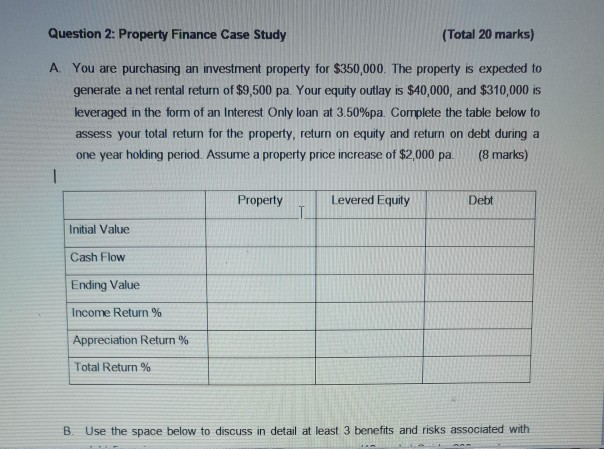

Question 2: Property Finance Case Study (Total 20 marks) A. You are purchasing an investment property for $350,000. The property is expected to generate a net rental return of $9,500 pa. Your equity outlay is $40,000, and $310,000 is leveraged in the form of an Interest Only loan at 3.50%pa Complete the table below to assess your total return for the property, return on equity and return on debt during a one year holding period. Assume a property price increase of $2,000 pa. (8 marks) Property Levered Equity Debt Initial Value Cash Flow Ending Value Income Return % Appreciation Return % Total Return % . Use the space below to discuss in detail at least 3 benefits and risks associated with

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts