Question: Question 2 Rainforest Saviours Organization (RSO) uses the deferral method for accounting for contributions and has no separate fund for restricted contributions. On January 1,

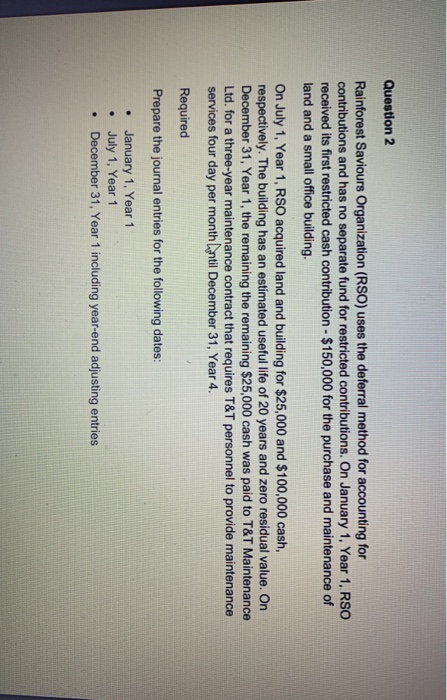

Question 2 Rainforest Saviours Organization (RSO) uses the deferral method for accounting for contributions and has no separate fund for restricted contributions. On January 1, Year 1, RSO received its first restricted cash contribution - $150,000 for the purchase and maintenance of land and a small office building. On July 1, Year 1, RSO acquired land and building for $25,000 and $100,000 cash, respectively. The building has an estimated useful life of 20 years and zero residual value. On December 31, Year 1, the remaining the remaining $25,000 cash was paid to T&T Maintenance Ltd. for a three-year maintenance contract that requires T&T personnel to provide maintenance services four day per month until December 31, Year 4. Required Prepare the journal entries for the following dates: January 1, Year 1 July 1, Year 1 December 31, Year 1 including year-end adjusting entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts