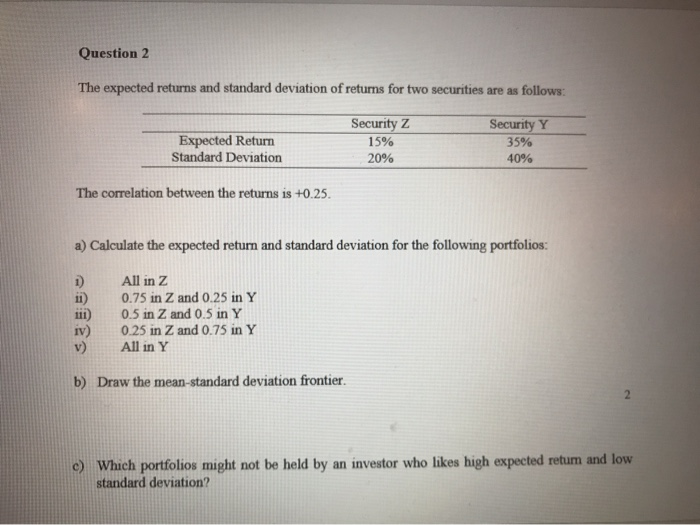

Question: Question 2 The expected returns and standard deviation of returns for two securities are as follows: Expected Return Standard Deviation Security Z 15% 20% Security

Question 2 The expected returns and standard deviation of returns for two securities are as follows: Expected Return Standard Deviation Security Z 15% 20% Security Y 35% 40% The correlation between the returns is +0.25. a) Calculate the expected return and standard deviation for the following portfolios: All in Z 0.75 in Z and 0.25 in Y 0.5 in Z and 0.5 in Y 0.25 in Z and 0.75 in Y All in Y b) Draw the mean-standard deviation frontier c) Which portfolios might not be held by an investor who likes high expected retum and low standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts