Question: thx QUESTION 14 The expected returns and standard deviation of returns for two securities are as follows: Security ABC Expected Return Standard Deviation Security DEF

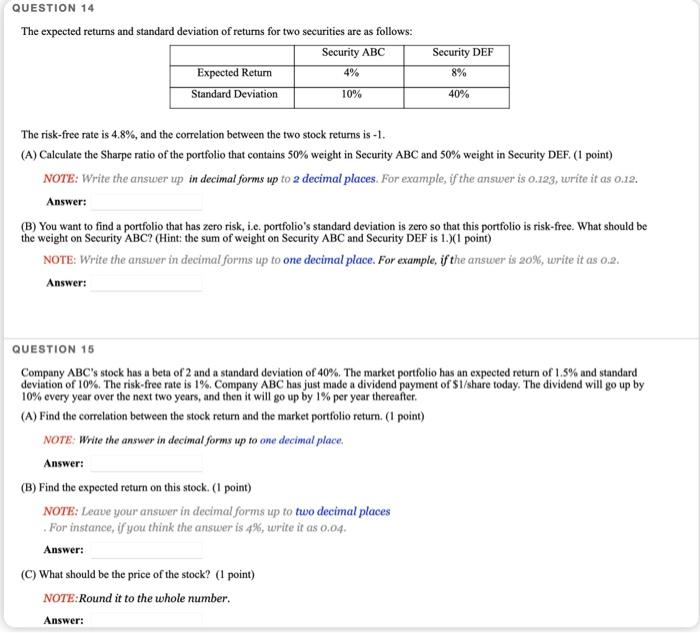

QUESTION 14 The expected returns and standard deviation of returns for two securities are as follows: Security ABC Expected Return Standard Deviation Security DEF 8% 4% 10% 40% The risk-free rate is 4.8%, and the correlation between the two stock returns is -1. (A) Calculate the Sharpe ratio of the portfolio that contains 50% weight in Security ABC and 50% weight in Security DEF (1 point) NOTE: Write the answer up in decimal forms up to 2 decimal places. For example, if the answer is 0.123, write it as 0.12. Answer: (B) You want to find a portfolio that has zero risk, i.e. portfolio's standard deviation is zero so that this portfolio is risk-free. What should be the weight on Security ABC? (Hint: the sum of weight on Security ABC and Security DEF is 1.)(1 point) NOTE: Write the answer in decimal forms up to one decimal place. For example, if the answer is 20%, write it as 0.2. Answer: QUESTION 15 Company ABC's stock has a beta of 2 and a standard deviation of 40%. The market portfolio has an expected return of 1.5% and standard deviation of 10%. The risk-free rate is 1% Company ABC has just made a dividend payment of S1/share today. The dividend will go up by 10% every year over the next two years, and then it will go up by 1% per year thereafter. (A) Find the correlation between the stock return and the market portfolio return. (I point) NOTE: Write the answer in decimal forms up to one decimal place. Answer: (B) Find the expected return on this stock. (1 point) NOTE: Leave your answer in decimal forms up to two decimal places For instance, if you think the answer is 4%, write it as 0.04. Answer: (C) What should be the price of the stock? (1 point) NOTE:Round it to the whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts