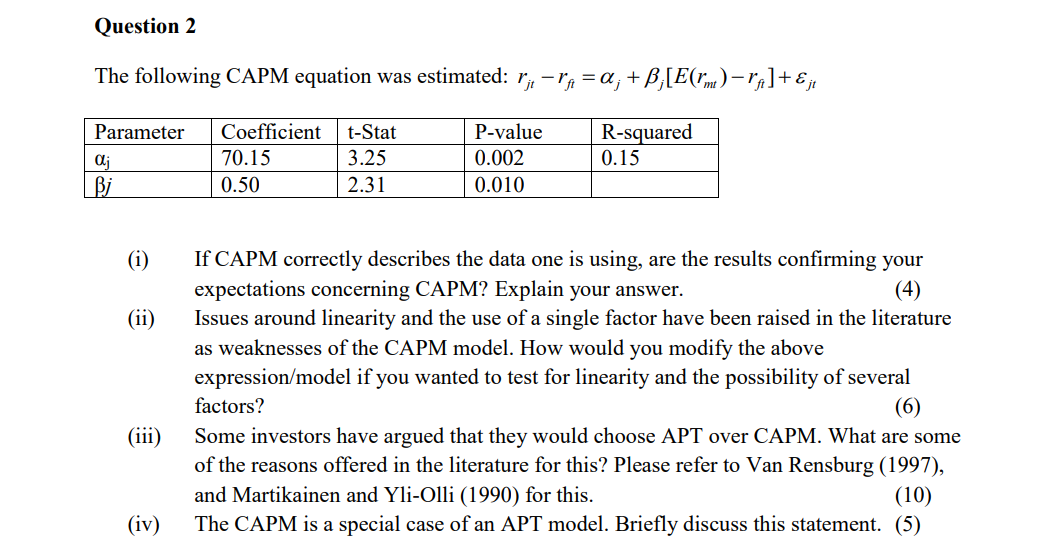

Question: Question 2 The following CAPM equation was estimated: ; -T's = a; + B,[E(I'm)-ral+ &; Parameter Coefficient t-Stat P-value R-squared Oli 70.15 3.25 0.002 0.15

Question 2 The following CAPM equation was estimated: "; -T's = a; + B,[E(I'm)-ral+ &; Parameter Coefficient t-Stat P-value R-squared Oli 70.15 3.25 0.002 0.15 Bj 0.50 2.31 0.010 (i) If CAPM correctly describes the data one is using, are the results confirming your expectations concerning CAPM? Explain your answer. (4) (ii) Issues around linearity and the use of a single factor have been raised in the literature as weaknesses of the CAPM model. How would you modify the above expression/model if you wanted to test for linearity and the possibility of several factors? (6) (iii) Some investors have argued that they would choose APT over CAPM. What are some of the reasons offered in the literature for this? Please refer to Van Rensburg (1997), and Martikainen and Yli-Olli (1990) for this. (10) (iv) The CAPM is a special case of an APT model. Briefly discuss this statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts