Question: Question 2: The following table gives returns in three possible states of the world for two assets, a bond index and a stock index. Stock

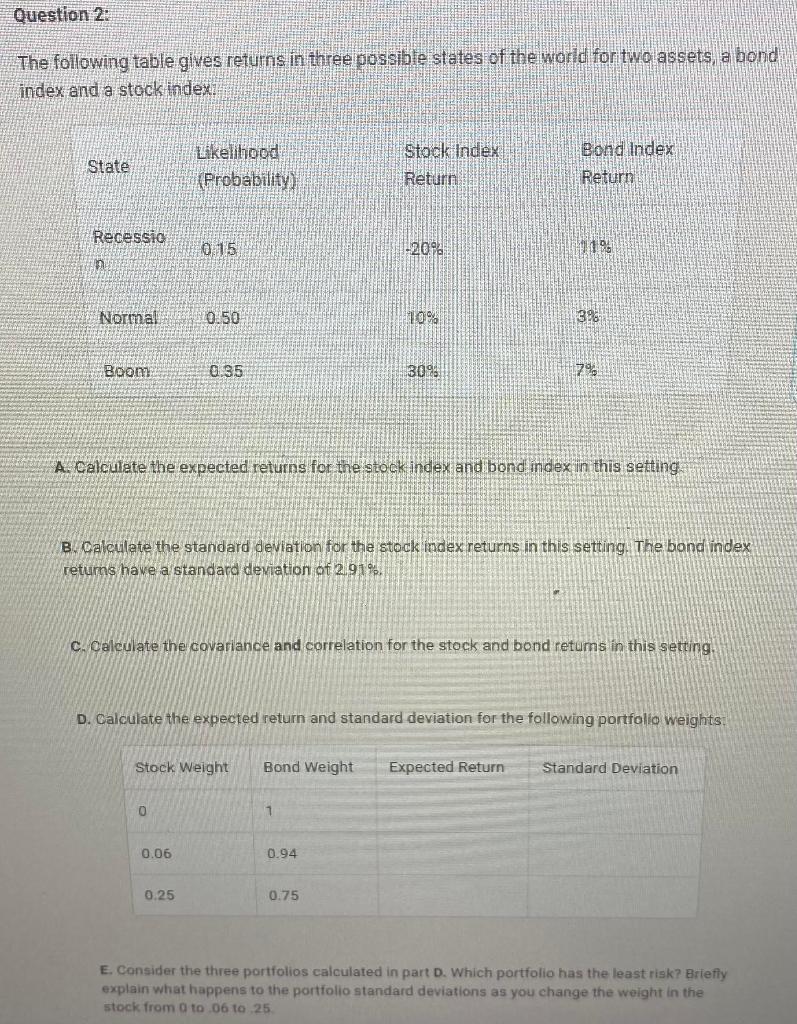

Question 2: The following table gives returns in three possible states of the world for two assets, a bond index and a stock index. Stock Index State Likelihood (Probability) Bond Index Return Return Recessio -20% 119. Normal 0.50 10% 38 Bloom 0.35 3098 7% A. Calculate the expected returns for the stock index and bond index in this setting. B. Calculate the standard deviation for the stock index returns in this setting. The bond index returns have a standard deviation of 2.91%. c. Calculate the covariance and correlation for the stock and bond retums in this setting, D. Calculate the expected return and standard deviation for the following portfolio weights. Stock Weight Bond Weight Expected Return Standard Deviation 1 0.06 0.94 0.25 0.75 E. Consider the three portfolios calculated in part D. Which portfolio has the least risk? Briefly explain what happens to the portfolio standard deviations as you change the weight in the stock from 0 to 06 to 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts