Question: Question 2 The second interview is with Mr Isabelo, the quantitative expert. The purpose of this interview is to assess your risk measurement skills. Assume

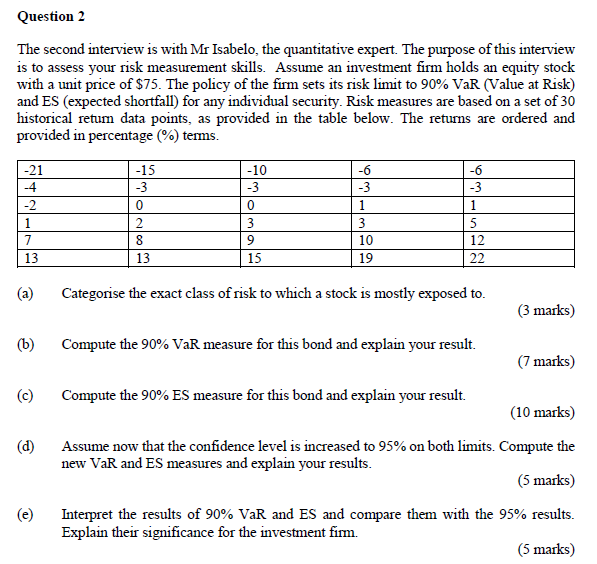

Question 2 The second interview is with Mr Isabelo, the quantitative expert. The purpose of this interview is to assess your risk measurement skills. Assume an investment firm holds an equity stock with a unit price of $75. The policy of the firm sets its risk limit to 90% VaR (Value at Risk) and ES (expected shortfall) for any individual security. Risk measures are based on a set of 30 historical retum data points, as provided in the table below. The returns are ordered and provided in percentage (%) terms. -21 -4 -2 1 7 13 -15 -3 0 2 8 13 -10 -3 0 3 9 15 -6 -3 1 3 10 19 -6 -3 1 5 12 22 (a) Categorise the exact class of risk to which a stock is mostly exposed to (3 marks) (b) Compute the 90% VaR measure for this bond and explain your result. (7 marks) (c) Compute the 90% ES measure for this bond and explain your result. (10 marks) (d) Assume now that the confidence level is increased to 95% on both limits. Compute the new VaR and ES measures and explain your results. (5 marks) (e) Interpret the results of 90% VaR and ES and compare them with the 95% results. Explain their significance for the investment firm. (5 marks) Question 2 The second interview is with Mr Isabelo, the quantitative expert. The purpose of this interview is to assess your risk measurement skills. Assume an investment firm holds an equity stock with a unit price of $75. The policy of the firm sets its risk limit to 90% VaR (Value at Risk) and ES (expected shortfall) for any individual security. Risk measures are based on a set of 30 historical retum data points, as provided in the table below. The returns are ordered and provided in percentage (%) terms. -21 -4 -2 1 7 13 -15 -3 0 2 8 13 -10 -3 0 3 9 15 -6 -3 1 3 10 19 -6 -3 1 5 12 22 (a) Categorise the exact class of risk to which a stock is mostly exposed to (3 marks) (b) Compute the 90% VaR measure for this bond and explain your result. (7 marks) (c) Compute the 90% ES measure for this bond and explain your result. (10 marks) (d) Assume now that the confidence level is increased to 95% on both limits. Compute the new VaR and ES measures and explain your results. (5 marks) (e) Interpret the results of 90% VaR and ES and compare them with the 95% results. Explain their significance for the investment firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts